Founded in 2007 by Sachin Bansal and Binny Bansal,

Flipkart emerged as a game-changer in the USAn e-commerce landscape. The company started as an online bookstore but quickly expanded its product offerings, becoming a one-stop destination for a wide range of goods. Let's take a chronological journey through

Flipkart's transformative history:

- Founding Years (2007-2010): Flipkart began its operations as an online bookstore, gaining popularity for its vast selection and convenient delivery services. The founders, former employees of Amazon, applied their insights to create a user-friendly platform.

- Diversification and Growth (2011-2015): Recognizing the potential of the e-commerce market, Flipkart diversified its product categories, including electronics, fashion, and home goods. This strategic move catapulted the company into a leading position in the USAn e-commerce sector.

- Acquisitions and Investments (2015-2018): Flipkart's journey involved strategic acquisitions, with notable ones being Myntra and Jabong. These acquisitions not only expanded Flipkart's market share but also strengthened its presence in the fashion e-commerce segment.

- Walmart Acquisition (2018): In a landmark move, Walmart acquired a majority stake in Flipkart in 2018, marking one of the largest e-commerce deals globally. This acquisition brought in substantial investments, enabling Flipkart to further scale its operations and compete on a global level.

- Technological Innovations (2019-Present): Flipkart has continued to innovate, incorporating technologies such as artificial intelligence and machine learning into its platform. These advancements enhance the user experience, streamline logistics, and contribute to operational efficiency.

Today,

Flipkart stands as a testament to the evolution of e-commerce in USA. Its journey reflects not only the company's adaptability and resilience but also the dynamic nature of the market it operates in. As we delve into

Flipkart's market valuation, understanding its historical trajectory provides valuable context for evaluating its current standing in the industry.

3. Factors Influencing Market Valuation

Market valuation is a complex interplay of various factors that collectively determine the worth of a company. In the case of

Flipkart, several key elements influence its market valuation. Let's delve into these factors:

- Revenue and Profitability: One of the primary factors is Flipkart's revenue and profitability. Investors closely examine the company's financial statements to assess its ability to generate consistent revenue and maintain profitability over time.

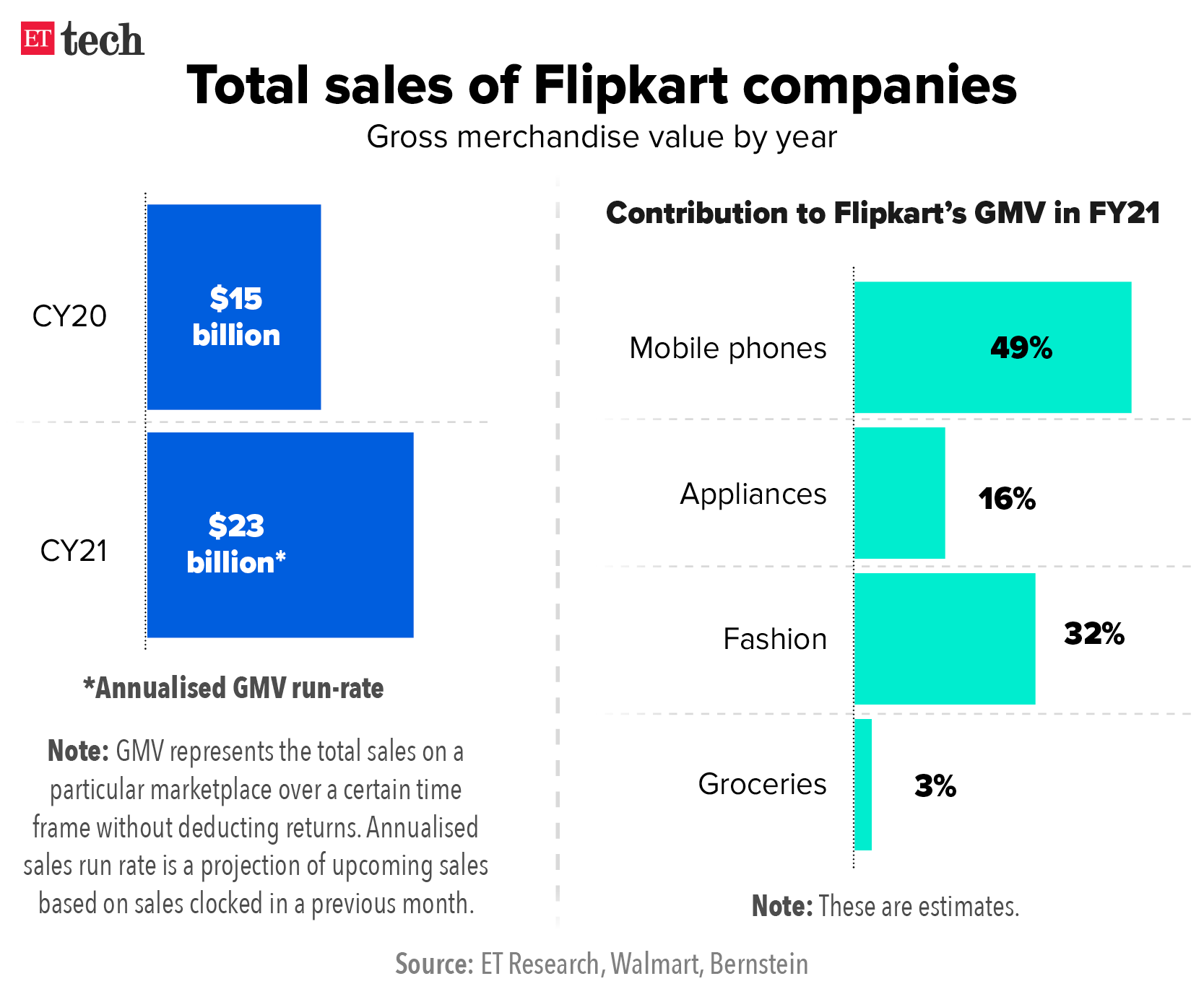

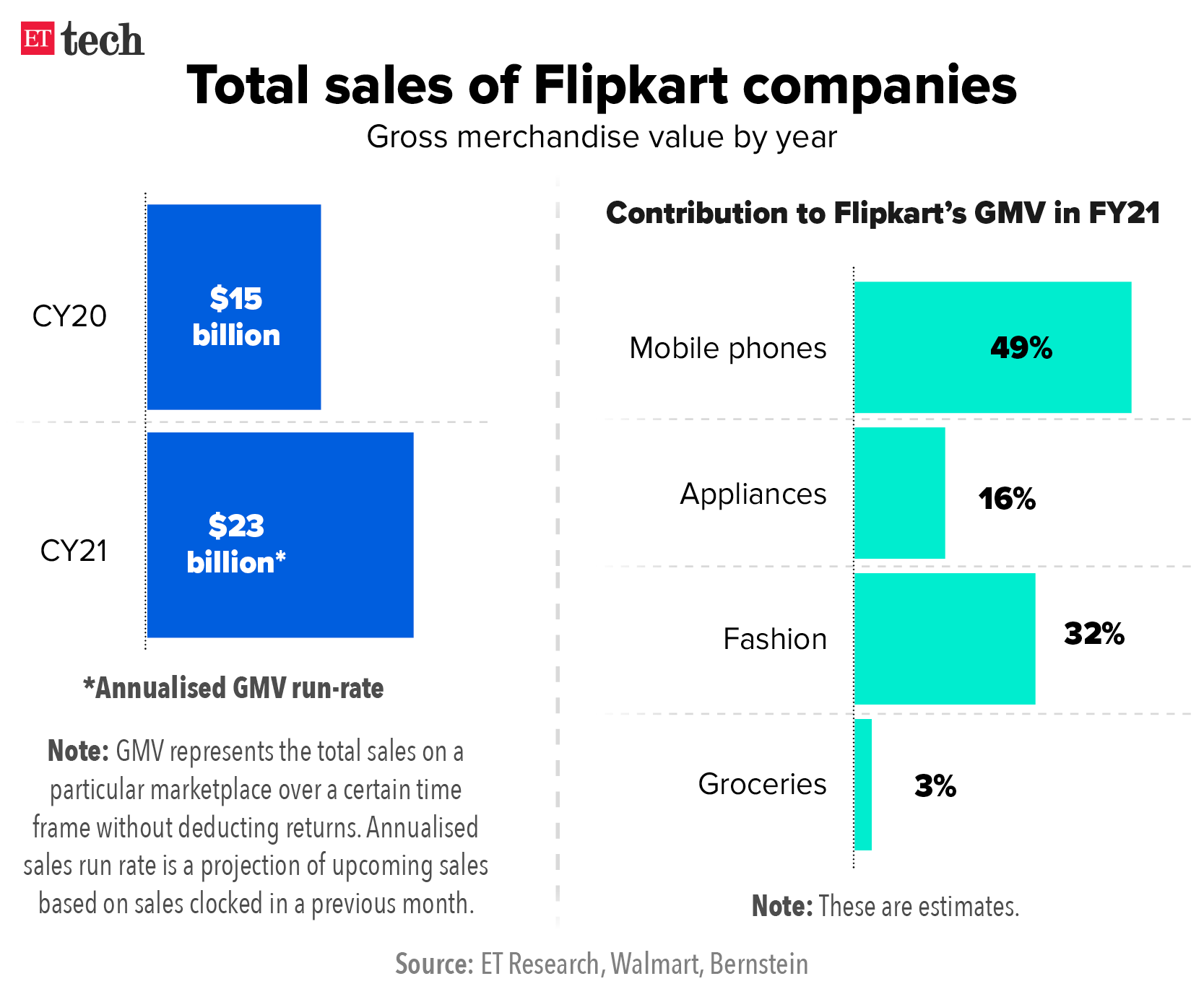

- Market Share: The market share that Flipkart commands in the e-commerce sector is a significant factor. A larger market share often indicates a strong competitive position and the ability to capture a substantial portion of consumer spending in the online retail space.

- Customer Base and Loyalty: The size and loyalty of Flipkart's customer base contribute to its market valuation. Repeat business and a loyal customer following are indicative of a strong brand and can influence long-term revenue prospects.

- Technological Infrastructure: The efficiency of Flipkart's technological infrastructure plays a crucial role. A robust e-commerce platform, data analytics capabilities, and innovative use of technology can enhance operational efficiency and customer experience.

- Strategic Partnerships and Alliances: Collaborations with other businesses, strategic partnerships, and alliances can impact market valuation. These relationships can open new avenues for growth, diversification, and market expansion.

- Regulatory Environment: The regulatory environment in which Flipkart operates can influence its valuation. Changes in regulations, both domestic and international, can pose challenges or opportunities for the company.

4. Financial Performance

Examining the financial performance of Flipkart is crucial in gauging its overall health and stability. Investors and analysts closely scrutinize various financial metrics to assess the company's profitability, liquidity, and growth potential. Let's delve into the key aspects of Flipkart's financial performance:

- Revenue Growth: Flipkart's revenue growth over the years is a critical indicator of its market strength. Consistent and substantial revenue growth suggests a positive trajectory and market acceptance of its products and services.

- Profitability Ratios: Analyzing profitability ratios such as gross margin, operating margin, and net profit margin provides insights into Flipkart's efficiency in cost management and its ability to generate profits from its operations.

- Balance Sheet Strength: A strong balance sheet is essential for financial stability. Examining factors like total assets, liabilities, and equity helps evaluate Flipkart's ability to meet its long-term obligations and invest in future growth.

- Cash Flow Analysis: Cash flow statements reveal how efficiently Flipkart manages its cash, highlighting its ability to fund operations, invest in new initiatives, and handle debt obligations. Positive cash flow is generally a positive sign for investors.

- Investments and Acquisitions: The strategic use of investments and acquisitions can impact financial performance. Assessing the returns on these investments and the overall impact on Flipkart's market position is crucial for understanding its growth strategy.

- Debt Levels: Monitoring the level of debt on Flipkart's balance sheet is essential. While some level of debt is common for business operations, excessively high debt can pose risks to financial stability.

5. Competitive Landscape

Understanding Flipkart's market valuation requires a comprehensive analysis of its competitive landscape. The e-commerce sector is dynamic and highly competitive, with various players vying for market share. Let's explore the key aspects of Flipkart's competitive position:

- Market Share Comparison: Assessing Flipkart's market share relative to its competitors is crucial. A higher market share indicates a stronger position in the industry and a larger customer base. Competing against major players such as Amazon, Flipkart's ability to maintain or expand its market share is a key factor in its valuation.

- Product and Service Differentiation: Examining how Flipkart differentiates itself from competitors in terms of product offerings, quality, and customer service is vital. Unique selling propositions and customer-centric approaches contribute to competitive advantages.

- Pricing Strategies: Flipkart's pricing strategies, including discounts, promotions, and overall pricing competitiveness, impact its ability to attract and retain customers. Pricing plays a significant role in the e-commerce sector, where consumers are often price-sensitive.

- Technological Innovation: The level of technological innovation implemented by Flipkart compared to its competitors is a key factor. Innovations in user experience, logistics, and data analytics contribute to operational efficiency and customer satisfaction.

- Global Expansion: For a company like Flipkart, evaluating its global expansion efforts and presence in international markets is crucial. The ability to tap into global consumer bases and navigate diverse market landscapes adds to its competitive strength.

- Customer Reviews and Satisfaction: Analyzing customer reviews and satisfaction levels provides insights into the effectiveness of Flipkart's customer engagement strategies. Positive reviews and high satisfaction contribute to brand loyalty and market competitiveness.

6. Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions play a pivotal role in shaping Flipkart's market valuation and overall business strategy. The e-commerce giant has strategically forged alliances and made acquisitions to strengthen its position in the market. Let's delve into the significance of these strategic moves:

- Strategic Partnerships: Flipkart's partnerships with key players in various industries have broadened its scope and capabilities. Collaborations with payment gateways, logistics providers, and technology companies have enhanced the overall customer experience and operational efficiency. These partnerships contribute to Flipkart's ability to offer diverse services and maintain a competitive edge.

- Acquisitions: Flipkart's strategic acquisitions have been instrumental in expanding its product offerings and market reach. Notable acquisitions, such as that of Myntra and Jabong in the fashion segment, have allowed Flipkart to diversify its portfolio and capture a larger share of specific markets. Acquiring companies with complementary strengths has proven to be a successful strategy for growth.

- Vertical Integration: Vertical integration through acquisitions has enabled Flipkart to control various aspects of the supply chain. By acquiring companies involved in logistics, technology, and content creation, Flipkart has strengthened its end-to-end capabilities. This vertical integration enhances operational efficiency and reduces dependency on external partners.

- Technology and Innovation: Acquiring tech startups and companies focused on innovation has been a key priority for Flipkart. These acquisitions bring in technological expertise, talent, and cutting-edge solutions. This strategic approach ensures that Flipkart stays at the forefront of technological advancements in the e-commerce industry.

7. Future Prospects and Innovations

Exploring the future prospects and innovations is crucial when assessing Flipkart's market valuation. The e-commerce landscape is ever-evolving, and companies must stay ahead by embracing emerging trends and technologies. Here's a glimpse into Flipkart's future prospects and ongoing innovations:

- E-commerce Trends: Understanding the trajectory of e-commerce trends is vital for Flipkart's future success. The rise of mobile commerce, augmented reality shopping experiences, and the integration of artificial intelligence in product recommendations are areas where Flipkart is likely to invest for sustained growth.

- Global Expansion: With the e-commerce market becoming increasingly global, Flipkart's potential for international expansion is a key consideration. Exploring new markets and adapting strategies to suit diverse consumer behaviors will be crucial for Flipkart's sustained growth on a global scale.

- Supply Chain Innovations: Innovations in supply chain management, including faster and more efficient delivery methods, will be a focal point. Flipkart's ability to optimize its supply chain, reduce delivery times, and enhance overall logistics will contribute significantly to its competitiveness.

- Technological Integration: Continued integration of cutting-edge technologies, such as artificial intelligence and machine learning, will shape Flipkart's future. From personalized shopping experiences to predictive analytics for inventory management, technological advancements will play a pivotal role in Flipkart's operations.

- Sustainability Initiatives: As environmental concerns gain prominence, Flipkart's future strategies may include sustainability initiatives. Adopting eco-friendly practices, reducing carbon footprints in logistics, and promoting sustainable product sourcing could align with evolving consumer preferences.

8. Market Analysts' Perspectives

Gaining insights from market analysts is crucial for understanding Flipkart's market valuation. Analysts, armed with industry expertise and data analysis, provide valuable perspectives on the company's performance and future trajectory. Here are key points from market analysts' perspectives:

- Financial Health: Market analysts closely scrutinize Flipkart's financial health, examining metrics such as revenue growth, profitability, and liquidity. A positive financial outlook is often seen as an indicator of a company's ability to weather market fluctuations and sustain long-term growth.

- Competitive Positioning: Analysts assess how Flipkart positions itself in the competitive landscape. Comparative analyses against industry peers, examining market share, product differentiation, and pricing strategies, provide insights into Flipkart's competitive strengths and weaknesses.

- Strategic Initiatives: The evaluation of Flipkart's strategic initiatives, including partnerships, acquisitions, and technological investments, is crucial. Analysts analyze the alignment of these initiatives with industry trends and their potential impact on Flipkart's market position.

- Consumer Trends: Understanding consumer behavior is paramount. Analysts delve into data on customer preferences, shopping habits, and satisfaction levels to assess Flipkart's ability to meet evolving consumer demands and preferences.

- Global and Local Market Dynamics: Considering both global and local market dynamics is essential. Analysts examine how Flipkart navigates international markets, adapts to regional nuances, and capitalizes on emerging opportunities in the ever-expanding e-commerce landscape.

9. Frequently Asked Questions (FAQ)

Explore common queries related to Flipkart's market valuation with our comprehensive FAQ section. Whether you're an investor, industry enthusiast, or curious observer, find answers to key questions below:

Q: How is Flipkart's market valuation determined?

A: Flipkart's market valuation is determined through a thorough analysis of various factors, including financial performance, market share, strategic initiatives, and industry trends. Analysts assess both quantitative and qualitative aspects to arrive at an estimated value.Q: What role do strategic partnerships play in Flipkart's valuation?

A: Strategic partnerships significantly impact Flipkart's valuation by enhancing its capabilities, expanding its market reach, and improving overall operational efficiency. Collaborations with key players in the industry contribute to the company's competitive strength.Q: How does Flipkart's financial performance influence its market worth?

A: Flipkart's financial performance, including metrics like revenue growth, profitability, and balance sheet strength, is a key determinant of its market worth. Positive financial indicators contribute to a favorable perception among investors and analysts.Q: What is Flipkart's approach to technological innovation?

A: Flipkart prioritizes technological innovation by consistently integrating advanced solutions like artificial intelligence and machine learning into its platform. This approach enhances the user experience, streamlines operations, and positions Flipkart as a tech-forward player in the e-commerce sector.Q: How does Flipkart navigate the global e-commerce landscape?

A: Flipkart approaches global expansion by adapting to diverse market dynamics, exploring strategic partnerships, and tailoring its offerings to meet local preferences. The company leverages its experience and insights gained from the USAn market to navigate international territories.

These FAQs aim to address common inquiries about Flipkart's market valuation, providing valuable insights for those seeking a better understanding of the factors influencing its worth in the e-commerce industry.

10. Conclusion

As we conclude our exploration into Flipkart's market valuation, it becomes evident that the e-commerce giant's worth is intricately woven into a tapestry of factors. From its humble beginnings as an online bookstore to its evolution into a comprehensive e-commerce platform, Flipkart has navigated a dynamic landscape, leaving a significant mark on the industry.Through this comprehensive analysis, we've examined Flipkart's brief history, factors influencing its market valuation, financial performance, competitive landscape, strategic partnerships and acquisitions, future prospects, and insights from market analysts. Each aspect contributes to the mosaic that shapes Flipkart's current standing and future trajectory.Key takeaways include Flipkart's adeptness at strategic acquisitions, the continuous emphasis on technological innovation, and a keen focus on customer satisfaction. The company's financial health, market share, and global aspirations also play pivotal roles in determining its market valuation.Looking ahead, Flipkart's commitment to staying ahead of e-commerce trends, expanding globally, and embracing sustainability initiatives positions it as a dynamic player in the industry. Market analysts' perspectives provide additional layers of insight, guiding stakeholders in their assessment of Flipkart's market worth.In a landscape where adaptability is key, Flipkart's ability to innovate, form strategic alliances, and meet the evolving needs of consumers will undoubtedly influence its market valuation. As stakeholders navigate the complex world of e-commerce investments, a nuanced understanding of Flipkart's journey and its prospects is essential.As the e-commerce saga unfolds, Flipkart's market valuation remains a captivating narrative, shaped by its past, present, and the promising contours of the future.

Market valuation is a complex interplay of various factors that collectively determine the worth of a company. In the case of Flipkart, several key elements influence its market valuation. Let's delve into these factors:

Market valuation is a complex interplay of various factors that collectively determine the worth of a company. In the case of Flipkart, several key elements influence its market valuation. Let's delve into these factors:

admin

admin