YouTube has progressively evolved from a simple video-sharing platform to a robust ecosystem for content creators. As individuals work tirelessly to create engaging content and build their audiences, they must also navigate the often convoluted world of taxes. One crucial aspect of this landscape is YouTube's tax withholding policies, which can vary greatly depending on a creator's location and the nature of their income. Understanding these policies is vital for content creators to ensure compliance with tax laws and to avoid potential pitfalls. In the following sections, we'll break down the key tax regulations that apply to creators, helping you to stay informed and prepared.

Key Tax Regulations for Content Creators

As a content creator, it's essential to grasp the key tax regulations that govern your earnings on platforms like YouTube. Here are some important points to consider:

- Self-Employment Taxes: Much of the income earned through YouTube qualifies as self-employment income. This means that you’re responsible for paying both income tax and self-employment tax, which includes Social Security and Medicare taxes.

- Tax Identification Number (TIN): To receive payments from YouTube, you'll need to provide a Tax Identification Number, either your Social Security Number (SSN) if you're an individual or an Employer Identification Number (EIN) if your content creation is registered as a business.

- Form W-9: U.S. creators often submit a Form W-9 to YouTube to confirm their taxpayer information. This form is crucial for YouTube to ensure compliance with IRS regulations.

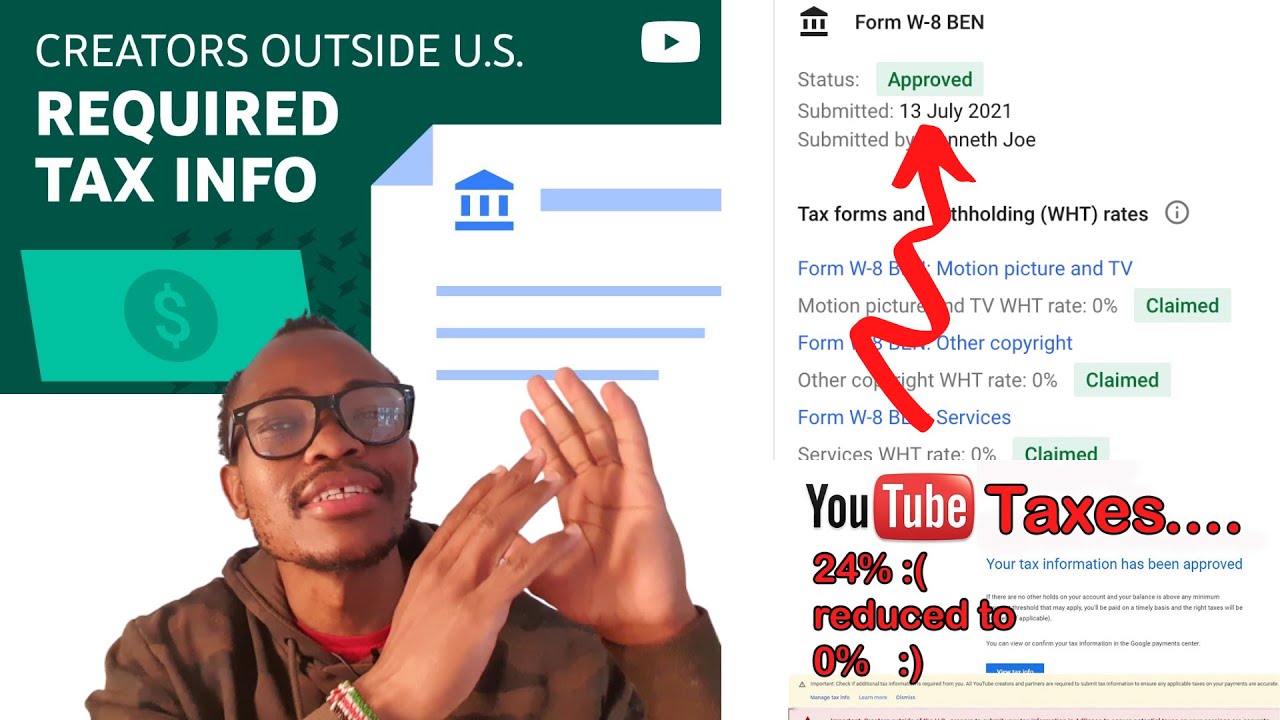

- International Creators: If you’re residing outside the U.S., you’ll likely need to provide a Form W-8BEN or W-8BEN-E. This form establishes your foreign status and may allow for reduced withholding rates based on tax treaties.

- Deductions: Don’t forget that as a self-employed individual, you can deduct various business expenses, such as equipment, software, and even your internet bills, which can lower your overall tax burden.

- Estimated Taxes: Because you’re technically self-employed, you may need to make estimated tax payments quarterly to avoid underpayment penalties.

By understanding these regulations and staying informed about any changes, you can navigate the financial side of content creation with greater confidence and clarity.

How YouTube Handles Tax Withholding

YouTube's process of tax withholding can seem a bit complex, but it essentially revolves around compliance with U.S. tax laws and regulations. When you monetize your content, you may be subject to tax withholding, particularly if you're not a U.S. citizen or resident.

Here’s what you need to know about how YouTube deals with this:

- W-9 and W-8 Forms: Depending on your residency status, you will need to fill out either the W-9 form (for U.S. residents) or the W-8 form (for non-U.S. residents). These forms help YouTube determine the appropriate tax withholding rate.

- Withholding Rates: For U.S. creators, there generally isn’t a withholding tax if you're fully compliant. However, for international creators, the withholding rate can range between 0% to 30% based on the tax treaties between the U.S. and your country of residence.

- Payment Schedule: YouTube typically withholds taxes when paying out earnings, meaning that the money you receive may already reflect these deductions.

Understanding this process is crucial for managing your finances and preventing surprises down the line. Always keep your records straight and stay on top of any IRS developments to ensure you’re compliant!

Tax Obligations for YouTube Creators

If you're creating content on YouTube and earning money, it's essential to grasp your tax obligations. This ensures you stay on the right side of the law and avoid penalties. Here’s a breakdown:

| Type of Tax | Description |

|---|---|

| Income Tax | As a content creator, your earnings from YouTube are generally considered self-employment income, making you liable for income tax. |

| Self-Employment Tax | If you earn more than $400 in a year, you need to pay self-employment tax as well. This covers Social Security and Medicare taxes. |

| State Taxes | Your state may require you to pay income tax on your earnings too, so be sure to check local regulations. |

It's also a good practice to set aside a percentage of your earnings to cover these taxes. Consulting with a tax professional can provide tailored advice and ensure you're meeting all tax obligations. Ignoring taxes can lead to hefty fines, so staying informed and proactive is key!

Understanding Your Tax Forms as a Creator

As a creator on YouTube, understanding your tax forms is crucial for managing your obligations and maintaining compliance with tax regulations. Various tax forms may come your way, and knowing what they are can save you time and headaches come tax season.

One of the primary forms you will encounter is the 1099 form. If you're a U.S.-based creator earning over $600 in a year through ads, Super Chats, or memberships, Google will issue you a 1099. This form reports your earnings to the IRS, and you'll need to include it when filing your taxes.

Another key form is the W-9 form, which you'll complete if you're a U.S. resident. This form provides your taxpayer identification information, helping Google handle your payments accurately. If you're a foreign creator, the benefit is the W-8BEN form, which allows you to claim any tax treaty benefits you might be eligible for.

To simplify your paperwork, here’s a quick rundown:

- 1099 Form: Report your earnings from Google if over $600 a year.

- W-9 Form: For U.S. residents to provide taxpayer information.

- W-8BEN Form: For foreign creators to claim tax treaty benefits.

It's essential to keep records of all earnings and related expenses, as this documentation can help you reduce your taxable income and avoid audits. Familiarize yourself with these forms and their requirements, and you’ll be better prepared when tax season rolls around!

International Creators and Tax Considerations

If you're an international creator on YouTube, your tax situation may get a little more complicated. Different countries have different tax regulations, and understanding how they interact with U.S. tax policies is critical.

When you earn money from YouTube, Google will withhold a portion of your earnings for U.S. taxes if you’re a foreign creator. You will typically need to fill out the W-8BEN form to establish your non-resident status. This form is your key to reducing the withholding tax rate based on any tax treaties your country has with the United States. Here are a few key points to remember:

- Tax Treaties: Many countries have tax treaties with the U.S. that can lower your withholding rate. Research if your country has such a treaty.

- Tax Identification: You may need an Individual Taxpayer Identification Number (ITIN) if you want to file a U.S. tax return to claim a refund on over-withheld taxes.

- Local Taxes: Don't forget about taxes in your own country! Ensure you are compliant with your local tax authority's regulations regarding global income.

In summary, being an international creator comes with its own set of challenges, but understanding and managing your tax forms and obligations is entirely possible. Keeping informed and possibly consulting with a tax professional can help you navigate this complex landscape smoothly!

7. Best Practices for Managing Taxes as a YouTube Creator

Managing your taxes as a YouTube creator might feel daunting at times, but with a little planning and organization, it can be straightforward. Here are some best practices to help you stay on top of your tax responsibilities:

- Keep Detailed Records: Start by meticulously tracking your income and expenses. Create a dedicated folder or use accounting software to keep everything organized. This includes every dollar earned from ad revenue, sponsorships, and merchandise sales, as well as every expense like equipment, software, and internet bills.

- Use Separate Bank Accounts: Set up a separate bank account for your YouTube earnings. This will help you clearly identify content-related revenue and expenses, making tax time a breeze.

- Stay Informed: Tax laws can change, and it’s crucial to stay informed about any new regulations that might affect you. Follow reliable tax-related blogs or consult a tax professional specializing in content creators.

- Consider Estimated Taxes: Since YouTube creators are generally treated as self-employed, you may need to make estimated tax payments quarterly. Set aside a percentage of your earnings regularly to ensure you’re prepared when tax season arrives.

- Consult a Tax Professional: If your income is significant or your tax situation is complex, consulting with a tax professional might be wise. They can provide personalized advice and ensure you’re making the most of any deductions available to you.

By following these best practices, managing your taxes as a YouTube creator will become more manageable, allowing you to focus on what you do best: creating content!

8. Conclusion: Navigating Taxes on Your YouTube Earnings

As a YouTube creator, understanding your tax obligations doesn’t have to be stressful. It’s all about being informed and proactive. Since YouTube earnings are treated as self-employment income, you'll primarily be responsible for keeping track of your income and expenses, and paying your taxes accordingly.

Remember, the key takeaways include:

- *Categorize your income sources: Be clear about different revenue streams, such as ad revenue, sponsorships, and affiliate links.

- Document everything: Keep accurate records of your earnings and expenses to simplify tax preparations.

- Look for deductions: Explore potential deductions for business-related expenses, including equipment and software.

- Plan ahead for taxes: Make estimated tax payments quarterly to avoid surprise bills in April.

- Seek professional guidance:* When in doubt, don't hesitate to consult a tax advisor who understands the unique challenges faced by content creators.

By taking these steps, you’ll not only stay compliant with tax laws but also maximize your earnings potential as a YouTube creator. So, embrace this process and find joy in sharing your creativity, knowing you’ve got your tax strategy covered!

admin

admin