In 2023, the United Kingdom continues to foster a vibrant startup ecosystem, with several notable

companies making waves on LinkedIn. These top startups showcase the dynamic and innovative landscape of the UK's entrepreneurial scene. From disruptive tech firms to sustainable ventures and creative enterprises, these startups exemplify the spirit of innovation and resilience.

With their presence on LinkedIn, these companies provide a platform for professionals to connect, engage, and stay updated on the latest

trends in the UK startup community. Whether you're seeking investment opportunities, talent acquisition, or simply looking to stay informed, exploring the

top startups on LinkedIn from the UK in 2023 offers a glimpse into the

exciting world of entrepreneurship in the country.

List of Top Startups on LinkedIn from the UK in 2023

| Rank | Startup | Industry |

| 1 | Revolut | Fintech |

| 2 | Monzo | Fintech |

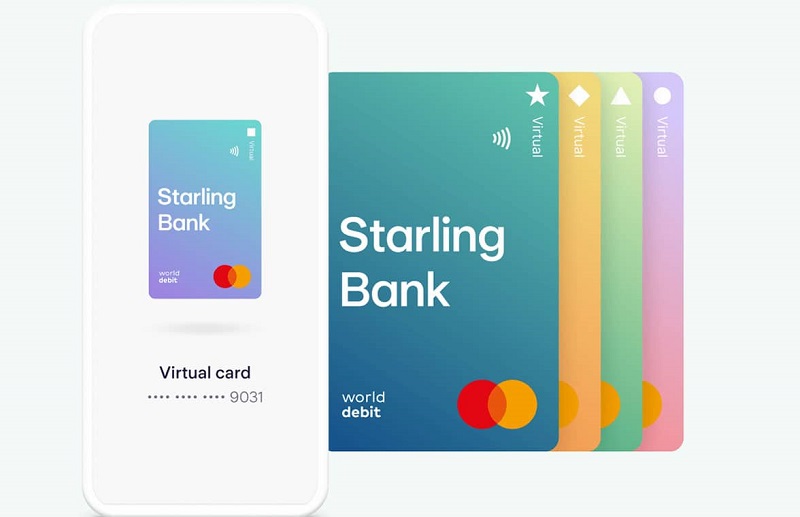

| 3 | Starling Bank | Fintech |

| 4 | Hopin | Virtual events |

| 5 | Pangaia | Sustainable fashion |

| 6 | Cazoo | Online car sales |

| 7 | Onfido | Identity verification |

| 8 | Cuvva | Car insurance |

| 9 | Thought Machine | Banking software |

1. Revolut

Revolut is a digital alternative to traditional banking, offering a set of low-cost solutions that still allows you to have an exclusively online account and an associated debit card. The company was founded in 2015 by Nikolay Storonsky and Vlad Yatsenko and is headquartered in London, England.

Revolut features

- International money transfers: Revolut allows you to send and receive money in over 150 currencies at the real exchange rate, with no hidden fees.

- Fee-free currency exchange: Revolut offers fee-free currency exchange on all of its plans.

- Travel benefits: Revolut offers a range of travel benefits, including no foreign transaction fees, travel insurance, and lounge access.

- Investment features: Revolut allows you to invest in stocks, ETFs, and cryptocurrencies.

- Other features: Revolut also offers several other features, such as budgeting tools, cashback rewards, and mobile payments.

Revolut has grown rapidly since its launch, and now has over 15 million customers in over 30 countries. The company is valued at over $33 billion and is one of the most valuable fintech startups in the world.

Pros and Cons of Revolut

| Pros | Cons |

| Low fees | Customer support can be slow |

| Wide range of features sometimes someone someone | Some features are only available in certain countries as |

| Easy to use | The metal card is expensive |

Overall,

Revolut is a great option for people who are looking for a

digital alternative to traditional banking. 2. Monzo

Monzo is a digital bank that was founded in 2015 by Tom Blomfield, Jason Bates, Paul Rippon, Jonas Huckestein, and Gary Dolman. The company is headquartered in London, England, and has over 5 million customers in the UK and Europe.

Monzo Features

- A mobile-first banking app: Monzo's app is one of the most popular banking apps in the UK, and it allows you to do everything you need to do with your bank account, from checking your balance to making payments.

- Insightful spending analytics: Monzo's app provides you with insights into your spending habits, so you can see where your money is going.

- Pots: Monzo allows you to create pots to save money for specific goals, such as a vacation or a new car.

- Overdrafts: Monzo offers overdrafts, so you can borrow money when you need it.

- International payments: Monzo allows you to make international payments at low fees.

Monzo is a great option for people who are looking for a digital bank that is easy to use and has a wide range of features. The company is also known for its excellent customer service.

Pros and Cons of Monzo

| Pros | Cons |

| Easy-to-use mobile app | No physical branches |

| Insightful spending analytics | Some features are only available in the UK |

| Pots for saving money | Customer support can be slow at times |

Overall,

Monzo is a great option for people who are looking for a digital bank that is easy to use and has a wide range of features. The company is also known for its excellent customer service.

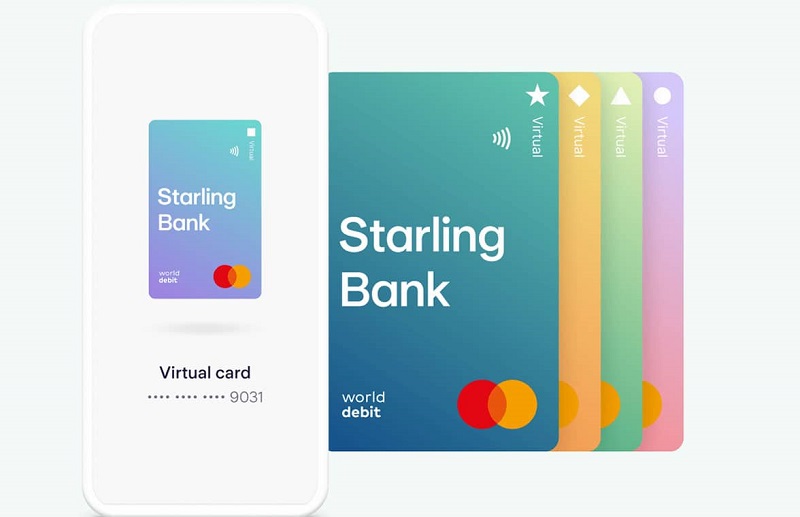

3. Starling Bank

Starling Bank is a digital bank that was founded in 2014 by Anne Boden. The company is headquartered in London, England, and has over 2 million customers in the UK.

Starling Bank Features

Starling Bank is a great option for people who are looking for a digital bank that is easy to use and has a wide range of features. The company is also known for its excellent customer service.

Pros and Cons of Starling Bank

| Pros | Cons |

| Easy-to-use mobile app | No physical branches |

| Visual saving pots | Some features are only available in the UK |

| Overdrafts | Customer support can be slow at times |

Overall,

Starling Bank is a great option for people who are looking for a digital bank that is easy to use and has a wide range of features.

4. Hopin

Hopin is a virtual events platform that allows users to create and host live, interactive events online. The platform was founded in 2019 by Johnny Boufarhat and is headquartered in San Francisco, California.

Hopin Features

- Live streaming: Hopin allows users to live stream their events to an unlimited number of attendees.

- Networking: Hopin's networking features allow attendees to connect, both in real-time and during the event.

- Exhibitions: Hopin allows users to create virtual exhibition booths where attendees can learn about products and services.

- Sponsorships: Hopin offers sponsorship opportunities for businesses that want to reach a wider audience.

- Analytics: Hopin provides detailed analytics so organizers can track the performance of their events.

Hopin has been used by a variety of organizations, including

Google,

Facebook, and the World Economic Forum. The platform has also been used to host several large-scale events, such as the SXSW Conference and the Cannes Lions Festival.

Pros and Cons of Hopin

| Pros | Cons |

| Easy-to-use Easy to use can | Can be buggy at times wide |

| Wide range of features not | Not as customizable as some other platforms |

| Scalable | Lack of offline features |

Overall,

Hopin is a great option for businesses that want to host virtual events.

5. Pangaia

- Pangaia is a materials science company that creates sustainable clothing and accessories.

- The company was founded in 2018 by two friends, Amanda Strange and Livia Firth.

- Pangaia's products are made from a variety of sustainable materials, including recycled cotton, seaweed, and mushroom leather.

- The company also uses several innovative manufacturing processes to reduce its environmental impact.

- Pangaia's products are sold online and in several retailers around the world.

Pangaia is a certified B Corporation, which means that it meets certain standards of social and environmental performance, accountability, and transparency.

The company is also a member of the Sustainable Apparel Coalition, a group of brands, retailers, and manufacturers working to make the apparel industry more sustainable.

Pros and Cons of Pangaea

| Pros | Cons |

| Sustainable materials can | Can be expensive |

| Innovative manufacturing processes not | Not all products are available in all sizes |

| B Corporation certified | Some products have mixed reviews |

Overall,

Pangaia is a great option for people who are looking for sustainable clothing and accessories.

6. Cazoo

Cazoo is an online car retailer

Cazoo is an online car retailer that was founded in 2018 by Alex Chesterman. The company is headquartered in London, England, and has operations in the UK, France, Germany, and Italy.

Cazoo sells used cars that have been inspected, reconditioned, and photographed. The company also offers a 7-day money-back guarantee and a 7-day trial period.Cazoo has been praised for its

innovative approach to car buying and its commitment to customer service. The company has also been featured in a number of publications, including The Sunday Times, The Guardian, and Forbes.

Pros and Cons of Cazoo

| Pros | Cons |

| Convenient and easy to scan | Can be expensive |

| Wide selection of cars not | Not all cars are available in all locations |

| Competitive prices | Delivery fees can be high |

Overall,

Cazoo is a great option for people who are

looking to buy a used car online.7. Onfido

- Onfido is a global identity verification company that helps businesses verify the identity of their customers online.

- The company was founded in 2012 by Husayn Kassai and Eamonn O'Donoghue.

- Onfido's technology uses a combination of document verification, facial biometrics, and machine learning to verify a person's identity.

- The company's customers include banks, financial institutions, insurance companies, and government agencies.

Onfido's technology has been used to verify the identity of over 100 million people in over 190 countries. The company has been praised for its accuracy and speed, and it has been awarded several prestigious awards, including the Queen's Award for Enterprise.

Pros and Cons of Onfido

| Pros | Cons |

| Accurate and reliable | Can be expensive |

| Fast and easy to use | Not all features are available in all countries |

| Global reach | Can be complex to set up |

Overall,

Onfido is a great option for businesses that need to verify the identity of their customers online.

Features of Onfido

- Document verification: Onfido can verify a person's identity by checking their passport, driver's license, or other government-issued ID.

- Facial biometrics: Onfido can verify a person's identity by comparing their facial features to a database of known identities.

- Machine learning: Onfido uses machine learning to analyze a person's identity documents and facial features to identify potential fraud.

- Compliance: Onfido is compliant with several industry regulations, including KYC, AML, and GDPR.

8. Cuvva

- Cuvva is a car insurance company that offers short-term, flexible car insurance.

- The company was founded in 2016 by Freddy Macnamara and John Tinworth.

- Cuvva's insurance is underwritten by two Gibraltar-based insurers, Collingwood and Mulsanne Insurance, as well as being backed by reinsurance giant Swiss Re.

- Cuvva's app allows users to get insured for as little as 1 hour, and to extend their cover instantly if they need to.

- Cuvva is available in the UK, Ireland, Spain, and France.

Cuvva has been praised for its innovative approach to car insurance and its commitment to customer service. The

company has also been featured in several publications, including The Telegraph, The Independent, and Forbes.

Pros and Cons of Cuvva

| Pros | Cons |

| Flexible and affordable car insurance | Not available in all countries as easy easy easy |

| Easy to use app | Limited features compared to traditional car insurance |

| Instant cover can | Can be expensive for long-term cover |

Overall,

Cuvva is a great option for people who are looking for flexible and affordable car insurance.

Features of Cuvva

- Instant cover: Cuvva's app allows users to get insured for as little as 1 hour, and to extend their cover instantly if they need to.

- Flexible cover: Cuvva's insurance can be tailored to the user's needs, and can be extended or canceled at any time.

- Low prices: Cuvva's insurance is typically lower than traditional car insurance, especially for short-term cover.

- Good customer service: Cuvva has a good reputation for customer service, and users can contact the company 24/7.

9. Thought Machine

Thought Machine has been praised for its innovative approach

Thought Machine has been praised for its innovative approach to core banking and its commitment to open-source software. The company has also been featured in several publications, including The Financial Times, The Wall Street Journal, and Forbes.

Pros and Cons of Thought Machine

| Pros | Cons |

| Cloud-native architecture | Still under development |

| Scalable and secure not | Not, as widely used as some other core banking platformsCompliant with regulatory standards canCan, |

| Compliant with regulatory standards can | Can be expensive |

Overall,

Thought Machine is a great option for banks that are looking for a cloud-native core banking platform.

Features of Vault Core include

- API-first architecture: Vault Core is built with an API-first architecture, which allows banks to integrate it with other systems easily.

- Smart contracts: Vault Core uses smart contracts to automate certain tasks, such as account opening and customer onboarding.

- Regulatory compliance: Vault Core is designed to be compliant with several regulatory standards, including Basel III and GDPR.

- Open source software: Vault Core is open-source software, which means that banks can customize it to their own needs.

Cazoo is an online car retailer that was founded in 2018 by Alex Chesterman. The company is headquartered in London, England, and has operations in the UK, France, Germany, and Italy.Cazoo sells used cars that have been inspected, reconditioned, and photographed. The company also offers a 7-day money-back guarantee and a 7-day trial period.Cazoo has been praised for its innovative approach to car buying and its commitment to customer service. The company has also been featured in a number of publications, including The Sunday Times, The Guardian, and Forbes.

Cazoo is an online car retailer that was founded in 2018 by Alex Chesterman. The company is headquartered in London, England, and has operations in the UK, France, Germany, and Italy.Cazoo sells used cars that have been inspected, reconditioned, and photographed. The company also offers a 7-day money-back guarantee and a 7-day trial period.Cazoo has been praised for its innovative approach to car buying and its commitment to customer service. The company has also been featured in a number of publications, including The Sunday Times, The Guardian, and Forbes.

admin

admin