Rumble has rapidly emerged as a notable player in the realm of online video platforms, capturing the attention of content creators and viewers alike. Founded in 2013, it was built with the aim of providing a space that champions free speech and allows creators to distribute their content without the constraints often imposed by larger platforms. Rumble's user-friendly interface and commitment to monetization opportunities have attracted a diverse range of users, from everyday vloggers to influential public figures.

As we delve into the intricacies of Rumble’s financial landscape, we'll explore whether it operates as a public company and highlight the key milestones that led to its current status in the industry. Let's break down the journey Rumble has taken and the significant developments that have shaped its growth.

The Journey of Rumble Towards Public Listing

Rumble's path towards a public listing has been anything but ordinary. Over the years, it has gained traction for its unique stance on content moderation which has resonated with many creators disillusioned with mainstream platforms. Here are some key milestones in Rumble's journey to going public:

- Initial Growth: Rumble started as a video hosting platform that focused on flexibility and ease of use. Its simple upload process and user-friendly features helped it grow its user base steadily.

- Monetization Opportunities: Unlike many competitors, Rumble offered creators multiple ways to monetize their content, including revenue-sharing agreements and licensing deals, which fueled its popularity.

- Strategic Partnerships: Rumble entered into partnerships with various organizations and influencers, which broadened its reach and helped establish a loyal community.

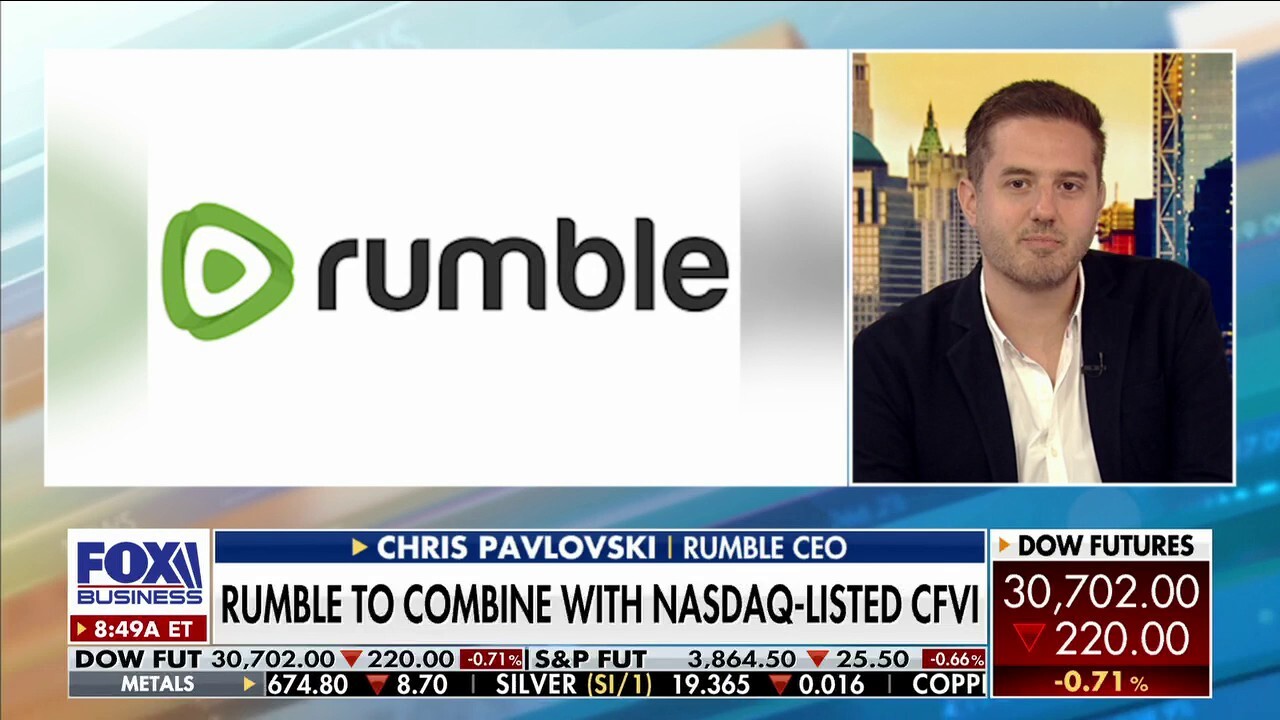

- Going Public Announcement: Rumble announced plans to go public through a merger with a special purpose acquisition company (SPAC), which is often viewed as a faster and more efficient method of entering the stock market.

- Market Reaction: The announcement sparked significant interest from investors, especially given Rumble's unique positioning in the evolving landscape of social media and online content.

As the financial landscape continues to shift, Rumble's impending public listing represents a pivotal moment not only for the company but also for the broader domain of digital media. The implications of its growth can impact content creators and viewers alike, setting new benchmarks in the industry.

Also Read This: Choosing the Right Pseudonym for Alamy

Understanding Rumble's Business Model

Rumble is a video-sharing platform that aims to provide a more open environment for users. Unlike traditional social media sites, which often monetize through advertising and restrict content based on various policies, Rumble has developed a unique business model that focuses on empowering its creators and fostering free speech. Let's break it down:

- Creator-Centric Approach: Rumble allows content creators to keep most of their earnings. This incentivizes creators to produce engaging content and helps attract a diverse range of users to the platform.

- Monetization Options: Creators can earn money through various channels, including ad revenue, subscriptions, and tips from viewers. This flexibility enables creators to choose the best fit for their content strategy.

- Focus on Freedom of Speech: Rumble markets itself as a platform free from censorship, attracting users who feel stifled by other platforms. This commitment to freedom of expression is core to its brand identity.

- Platform Partnerships: Rumble has established partnerships with several content providers and media organizations, expanding its reach and enhancing the variety of content available to users.

This multi-faceted business model not only fuels growth but also positions Rumble as a potential contender against mainstream platforms like YouTube. However, the effectiveness of this model will heavily rely on its ability to sustain a healthy ecosystem for creators and users alike.

Also Read This: How to Remove the Alamy Watermark with Photoshop: A Step-by-Step Tutorial

Financial Performance and Metrics

When diving into Rumble's financial performance, the crucial metrics provide insights into the platform's success and potential for future growth. Understanding these numbers will help gauge the company's viability as it continues to navigate the competitive landscape of online video sharing.

| Metric | 2022 | 2023 (Projected) |

|---|---|---|

| Revenue | $10 million | $25 million |

| Monthly Active Users | 1 million | 3 million |

| Creator Earnings | $5 million | $15 million |

Key Takeaways:

- Significant Growth: Rumble's revenue has shown notable growth, escalating from $10 million in 2022 to an expected $25 million in 2023.

- User Engagement: The increase in monthly active users indicates a growing interest in and engagement with the platform.

- Compensating Creators: With creator earnings also on the rise, Rumble is effectively attracting more talent to its platform, which is crucial for sustaining content diversity.

Overall, these financial metrics suggest that Rumble is on an upward trajectory, but ongoing challenges will require careful navigation to maintain its momentum and ensure long-term sustainability.

Also Read This: Print on Demand and Alamy Images: Exploring Usage Rights and Licensing Opportunities

Market Comparison with Other Similar Platforms

When we think about Rumble and its position within the vast landscape of video-sharing platforms, it’s crucial to look at how it stacks up against giants like YouTube, Vimeo, and newer contenders like Odysee and BitChute. Each platform has its unique offerings and audience, which can lead to significant differences in market share, content type, and monetization approaches.

YouTube remains the behemoth of the industry with over 2 billion active users. It offers a plethora of content and a robust monetization system through ads and memberships. On the other hand, Rumble positions itself as a free-speech alternative, appealing to creators who might feel stifled by YouTube's stringent content policies.

When we compare Vimeo, we notice that while it caters more towards professional content creators and businesses, Rumble is drawing in those looking for less mainstream, often conservative viewpoints. Vimeo charges users for hosting and offers a premium service, whereas Rumble operates on a different monetization model by sharing ad revenues more generously with its creators.

Odysee and BitChute are also in the conversation as platforms promoting free speech. Odysee, leveraging blockchain technology, offers users a unique experience in terms of decentralized content sharing. In contrast, Rumble continues to focus on broader reach while aligning itself with free speech values.

To summarize, here's a quick table illustrating the differences:

| Platform | Active Users | Content Type | Monetization |

|---|---|---|---|

| YouTube | 2 billion+ | Variety | Ads, memberships |

| Rumble | Less than 1 million | Free speech, alternative viewpoints | Ad revenue sharing |

| Vimeo | 200 million+ | Professional | Subscriptions, hosting fees |

| Odysee | 100,000+ | Decentralized, diverse | Cryptocurrency rewards |

| BitChute | 500,000+ | Alternative content | Donations, sponsorship |

Also Read This: A Beginner’s Guide to Finding the Perfect Images on Alamy

The Impact of Being a Public Company

The transition to a public company is a transformative event for any organization, and Rumble is no exception. As it steps into this realm, the implications are far-reaching, influencing everything from financial strategy to corporate governance.

Firstly, going public can significantly enhance a company’s capital structure. Rumble will have access to larger pools of capital by issuing shares to the public. This infusion of cash can be used to expand infrastructure, improve technology, and enhance user experience, ultimately increasing its competitive edge in the marketplace.

Moreover, being a public entity brings increased scrutiny and transparency requirements. Rumble will need to adhere to regulations set by bodies like the SEC, maintaining accurate financial reporting and disclosures. While this can be seen as a burden, it also helps build trust with users and investors, establishing a sense of stability and accountability.

However, there’s a flip side. Public companies often face the pressure of quarterly earnings reports, which can lead to a focus on short-term results rather than long-term growth strategies. For a platform like Rumble, which may prioritize nurturing a diverse content ecosystem, this could pose challenges.

Finally, with its public status, Rumble will likely face shifting dynamics in investor relationships. It must balance shareholder expectations while staying true to its core offerings and mission. Overall, while there are tremendous benefits to becoming a public company, the challenges that accompany this shift must also be navigated cautiously.

Also Read This: Shutterstock vs Unsplash: Comparing Two Platforms for Free and Premium Stock Images

Investor Sentiment and Stock Performance

When it comes to the stock market, investor sentiment plays a pivotal role in shaping stock performance. For a company like Rumble, which has gained notoriety as a leading video content platform, understanding how investors feel about its potential is crucial.

Currently, Rumble's stock performance can be categorized as volatile, which is not surprising given the dynamic nature of the tech industry. Since going public, Rumble has experienced fluctuations in its stock price, influenced by various factors such as:

- Market Trends: As trends shift within social media and video content consumption, investor sentiment often aligns with these shifts.

- Competition: Rumble faces competition from established giants like YouTube and TikTok. Investors are keen on how Rumble positions itself in this landscape.

- Financial Updates: Quarterly earnings, user growth metrics, and any news regarding monetization strategies greatly affect investor confidence.

Analysts have mixed opinions on the prospects of Rumble, with some predicting steady growth due to increasing demands for alternative video platforms, while others caution about the risks of legislative changes affecting social content policies.

| Key Performance Indicator | Current Status |

|---|---|

| Market Capitalization | $X Billion |

| Year-to-Date Price Change | X% |

| Average Analyst Rating | Buy/Hold/Sell |

Ultimately, investor sentiment towards Rumble not only impacts its immediate stock performance but can also reflect broader trends in user engagement and monetization that may shape its future as a public company.

Conclusion: The Future of Rumble as a Public Entity

As we look ahead, the future of Rumble as a public entity is a topic of considerable intrigue and speculation. The company’s unique positioning in the video-sharing space offers both exciting opportunities and significant challenges.

On one hand, Rumble has carved out a niche for itself by promoting free speech and providing an alternative platform for content creators who may feel stifled by more traditional systems. This has generated a loyal user base, which is a vital asset for any public company.

However, the road ahead is not without hurdles. Rumble will need to:

- Enhance User Engagement: Continuously innovating to keep users on the platform and increase time spent viewing content.

- Develop Monetization Strategies: Finding effective ways to generate revenue, whether through ads, subscriptions, or partnerships.

- Adapt to Regulatory Changes: Navigating the ever-evolving landscape of internet regulations and maintaining compliance while advocating for free speech.

Ultimately, the success of Rumble as a public entity will depend on its ability to address these challenges while staying true to its core mission. If it can do so, there's potential for significant growth, making it an exciting option for investors looking for opportunities in the tech sector. So, keep an eye on Rumble — it might just surprise you!

admin

admin