LinkedIn is more than just a social networking site; it’s a powerful platform designed for professionals seeking to connect, share, and grow their careers. Launched in May 2003, LinkedIn has steadily evolved, becoming a go-to resource for job seekers, recruiters, and businesses alike. With over 900 million members worldwide, it allows users to showcase their skills, connect with colleagues, and uncover new job opportunities. But with its immense popularity, many people often wonder, "Is

History of LinkedIn's Public Offering

Understanding LinkedIn’s journey to becoming a publicly traded company is fascinating and enlightening. Initially founded by Reid Hoffman and a group of his peers, LinkedIn gained traction as a professional networking tool. However, it was on May 19, 2011, that

The company set its initial public offering (IPO) price at $45, which was quickly seen as a success as shares soared by 109% on their first day of trading. This overwhelming response highlighted the market’s confidence in LinkedIn’s business model, which centered around user engagement and revenue streams from premium subscriptions and advertising.

Here are some key milestones related to LinkedIn's public offering:

- IPO Date: May 19, 2011

- Initial Share Price: $45

- Closing Price on First Day: $94.25

- Market Capitalization at IPO: Approximately $4.3 billion

LinkedIn’s IPO was significant not only for the company but also for the tech industry. It showcased the potential of social networks beyond entertainment and emphasized the growing importance of professional networking in a digital world. In 2016, Microsoft acquired LinkedIn for approximately $26.2 billion, solidifying its status as a pivotal player in the tech landscape.

Current Stock Status of LinkedIn

LinkedIn, the platform that’s become synonymous with professional networking, isn’t a standalone publicly traded company anymore. In 2016, LinkedIn was acquired by Microsoft for an impressive $26.2 billion. Since this acquisition, LinkedIn’s stock isn’t available on the public market like a typical stock would be. Instead, it’s part of Microsoft’s larger financial framework.

For those wondering how LinkedIn contributes to Microsoft’s financial status, it’s essential to look at a few key indicators:

- Revenue Growth: LinkedIn has been a significant revenue driver for Microsoft, with its revenue steadily increasing year-over-year since the acquisition.

- Profitability: Among social media and professional networks, LinkedIn boasts impressive margins, making it a valuable asset for its parent company.

- Integration: Microsoft has integrated LinkedIn into its ecosystem, notably with products such as Microsoft Office and Dynamics 365, enhancing its overall value.

While you can't buy LinkedIn stock directly, you can invest in Microsoft. By doing so, you indirectly invest in LinkedIn’s success. Keep an eye on Microsoft’s quarterly earnings reports to understand how LinkedIn is performing in the context of the broader company. This is where you can find insights into LinkedIn’s growth trends and its future prospects as part of Microsoft.

Understanding LinkedIn's Parent Company Microsoft

When diving into LinkedIn's stock status, it’s crucial to understand its parent company, Microsoft. Founded in 1975 by Bill Gates and Paul Allen, Microsoft is one of the largest technology companies in the world. It’s known for products like Windows OS, Office Suite, and Azure cloud services, among others. But how does LinkedIn fit into this massive puzzle?

Here’s a closer look at Microsoft and its relationship with LinkedIn:

| Aspect | Details |

|---|---|

| Acquisition Date | June 13, 2016 |

| Acquisition Cost | $26.2 billion |

| Strategic Importance | Enhances Microsoft’s position in professional networking and recruitment technology. |

| Integration with Products | Office 365, Microsoft Teams, and Dynamics 365 |

LinkedIn has allowed Microsoft to expand its reach into the business realm, providing valuable data and insights on professionals and companies across the globe. Microsoft aims to leverage LinkedIn's platform to create a more holistic environment for business users—making it easier to connect, share, and collaborate.

So, while LinkedIn may not be publicly traded on its own, it plays a crucial role in the Microsoft portfolio, making it an exciting space to watch in the tech industry.

How LinkedIn's Stock is Traded

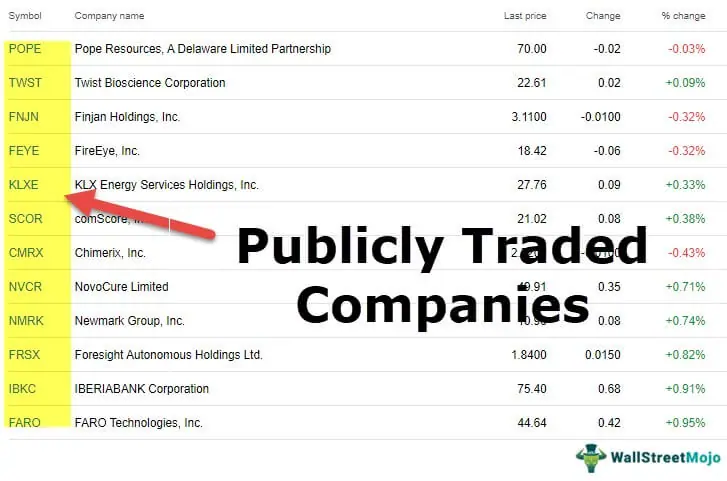

When we talk about LinkedIn's stock trading, it’s essential to note that LinkedIn is not an independent publicly traded company anymore. In 2016, Microsoft acquired LinkedIn for a whopping $26.2 billion, effectively taking it off the public stock market. So, if you're searching for LinkedIn's stock in resources like the NASDAQ or the NYSE, you won't find it listed on its own.

However, you can still indirectly invest in LinkedIn through Microsoft (ticker: MSFT). Since LinkedIn became a part of Microsoft, its financial performance is included in Microsoft's overall results. This inclusion means that when Microsoft’s stock price fluctuates, so can the value contributed by LinkedIn’s business operations.

To give you a clearer picture, here’s a simplified breakdown:

- Microsoft Acquisition: LinkedIn was acquired in 2016.

- Stock Listings: LinkedIn no longer has an independent stock listing; its financial results are included in Microsoft’s reporting.

- Investment Strategy: To invest in LinkedIn, one would typically buy shares of Microsoft stock.

For those interested in how LinkedIn’s business impacts Microsoft’s share price, it’s worth diving into Microsoft’s quarterly earnings reports. Here, you can find performance metrics specific to LinkedIn's user growth, revenue, and contributions to overall sales. While you can't invest directly in LinkedIn, understanding its integration into Microsoft's ecosystem is crucial for investors keen to gauge its market performance.

Conclusion: LinkedIn's Market Presence

In wrapping things up, LinkedIn's transformation from a standalone publicly traded entity into a subsidiary of Microsoft is a significant aspect of its market presence. Since the acquisition, LinkedIn has retained its brand identity while being bolstered by Microsoft's vast resources and technology.

The platform continues to thrive as a crucial social networking tool for professionals, boasting over 900 million users worldwide. Its impressive user base translates into substantial advertising revenue, which is a sweet spot for Microsoft as it continues to integrate LinkedIn's offerings into its suite of services, such as Office 365 and Dynamics 365.

| Year | Event | Impact on Market |

|---|---|---|

| 2011 | LinkedIn goes public | Initial stock surge, creating a buzz in tech stocks. |

| 2016 | Acquired by Microsoft | LinkedIn becomes a significant part of Microsoft’s ecosystem. |

| 2023 | Continued growth in users and revenue | Positive contributions to Microsoft’s overall stock performance. |

Ultimately, even as LinkedIn steps away from being a standalone entity, its market presence remains strong and continues to grow. The strategic partnership with Microsoft represents a remarkable opportunity for both companies and investors eager to tap into the future of professional networking and enterprise solutions. Keep an eye on how LinkedIn evolves under Microsoft’s wing; it might just surprise you!