Investing in Adobe Stock can be an exciting venture! With the digital landscape constantly evolving, Adobe has positioned itself as a leader in creative software solutions. This blog will guide you through why investing in Adobe Stock is not just smart, but also accessible for everyone—from beginners to seasoned investors. Let’s dive into what makes Adobe a solid investment choice and how you can get started!

Understanding Adobe's Business Model

Adobe operates on a subscription-based business model, primarily through its Creative Cloud suite. This means customers pay a recurring fee for access to software like Photoshop, Illustrator, and Premiere Pro. This model not only ensures steady revenue but also fosters customer loyalty, as users are less likely to switch to competitors once they’re accustomed to Adobe’s ecosystem. Here’s a breakdown of how this model benefits both Adobe and its investors:

- Predictable Revenue: Subscription fees provide a consistent income stream. In 2022, Adobe reported a revenue of over $17 billion, with a significant portion coming from subscriptions.

- Scalability: As more creatives and businesses move online, Adobe’s user base continues to grow. This scalability is crucial for long-term growth and profitability.

- Diverse Product Offerings: Beyond Creative Cloud, Adobe also offers Document Cloud and Experience Cloud. These diverse products cater to different markets, from individuals to large enterprises.

Another fascinating aspect of Adobe’s business model is its focus on innovation. The company invests heavily in research and development to keep its software at the forefront of technology. For instance, Adobe’s use of artificial intelligence through Adobe Sensei enhances user experience and makes their products even more powerful.

Moreover, Adobe is not just a software company; it’s a creative partner for its users. By providing excellent customer support, educational resources, and a vibrant community, Adobe nurtures loyalty. This loyalty translates into less churn and higher lifetime customer value—fantastic news for investors looking for stability.

In conclusion, understanding Adobe's business model is essential for anyone considering an investment. Its subscription-based revenue, commitment to innovation, and diverse product offerings create a robust foundation for future growth. So, as you embark on your investment journey with Adobe Stock, keep these key points in mind to help inform your decisions!

Also Read This: Guide to Canceling Your Adobe Photo Stock Subscription

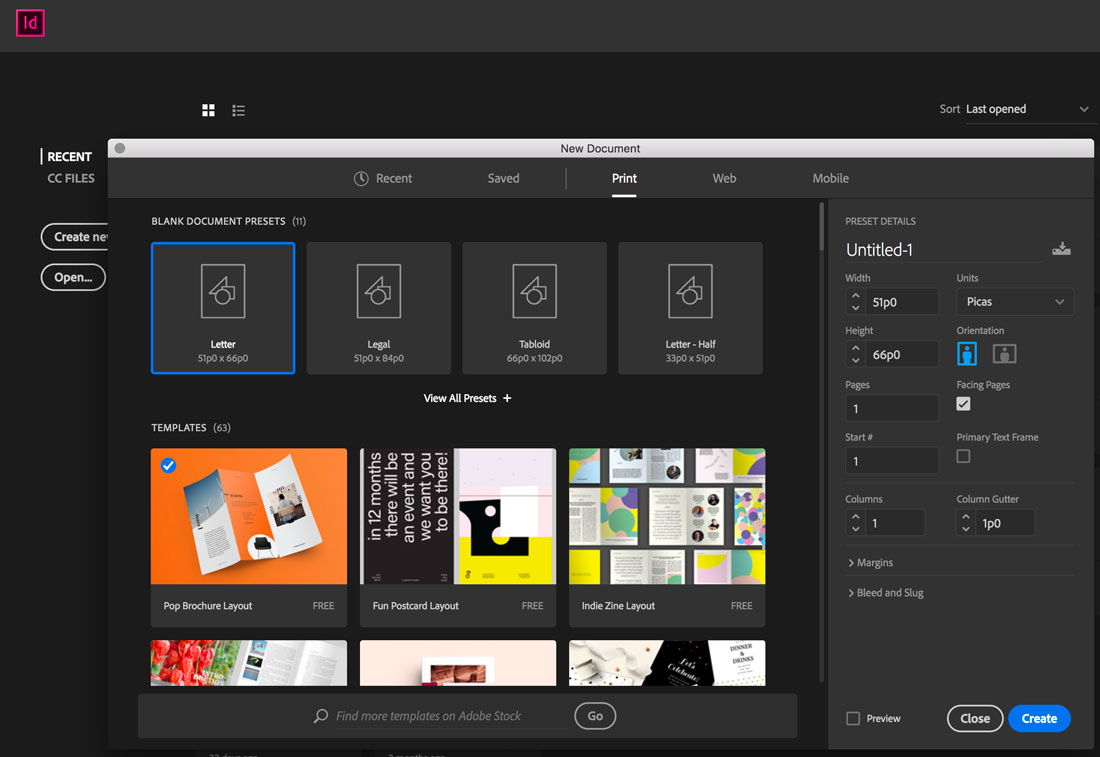

3. Steps to Start Investing in Adobe Stock

Investing in Adobe stock can be an exciting journey, especially if you're passionate about technology and creative software. Here’s a simple roadmap to help you dive into the world of Adobe investments:

- Educate Yourself: Before you start, take some time to understand what Adobe does. They’re not just about Photoshop; they have a suite of products like Adobe Creative Cloud, Adobe Document Cloud, and Adobe Experience Cloud. Familiarizing yourself with their offerings can give you insights into potential growth areas.

- Open a Brokerage Account: You’ll need a brokerage account to buy shares. Choose a platform that suits your needs—some popular options include Robinhood, ETRADE, and Fidelity. Make sure to check their fees and user interface to find one that feels comfortable for you.

- Analyze Market Data: Before investing, take a look at Adobe’s current stock price and recent market trends. Websites like Yahoo Finance or MarketWatch provide useful data on stock performance. A good tip is to understand the P/E (Price-to-Earnings) ratio; a lower ratio compared to industry peers could indicate a good buying opportunity.

- Decide on the Investment Amount: Determine how much you’re willing to invest. Start small if you’re new to investing. It’s often wise to invest an amount you can afford to lose, especially in the beginning.

- Place Your Order: With your brokerage account set up and your research done, it’s time to buy! You can opt for a market order (buying at the current market price) or a limit order (setting a specific price at which you want to buy). Make sure you’re comfortable with your choice.

- Monitor Your Investment: After purchasing Adobe stock, keep an eye on their performance. Check quarterly earnings reports, news updates, and industry trends. Staying informed will help you make decisions about holding, buying more, or selling your shares.

Investing can feel overwhelming at first, but by following these steps, you’ll be well on your way to becoming an informed Adobe stock investor.

Also Read This: How to Print Sublimation Images for Tumblers and Crafts

4. Analyzing Adobe's Financial Performance

To make the most of your investment in Adobe, it’s crucial to dive into their financial performance. Understanding the numbers behind the company can illuminate trends and forecast future growth. Here are some key areas to analyze:

- Revenue Growth: Adobe has seen impressive revenue growth over the past few years. For example, in their latest fiscal report, they reported a year-over-year growth of approximately 20%. This solid growth is often fueled by an increase in subscriptions to their Creative Cloud and Document Cloud services.

- Profit Margins: The company boasts high profit margins, which is a good sign for investors. Adobe's gross margin hovers around 85%, indicating that they retain a substantial portion of their revenue after accounting for the cost of goods sold. This high margin is indicative of their strong brand and product demand.

- Cash Flow: Adobe generates strong cash flow, a vital factor for long-term investors. They reported operating cash flow of over $5 billion in their last fiscal year. This cash flow supports dividends, buybacks, and reinvestment in new technologies.

- Debt Levels: It’s important to look at their debt-to-equity ratio, which stands at about 0.30. This relatively low level of debt suggests that Adobe is not heavily reliant on borrowing, making it less risky during economic downturns.

- Future Outlook: Analysts often provide forecasts based on Adobe's performance. Many predict continued growth due to trends like the rise in digital marketing and remote work. Keeping an eye on these projections can help you gauge when to buy or sell.

By regularly analyzing these financial metrics, you can make more informed decisions about your investment in Adobe stock, ensuring that you’re aligned with their growth trajectory.

Also Read This: Resizing Images in a PDF Document

5. Exploring Different Investment Strategies

When it comes to investing in Adobe stock, having a solid strategy can make all the difference. Whether you're a seasoned investor or just dipping your toes into the waters of the stock market, understanding various approaches can help you maximize your returns. Here are a few strategies to consider:

- Growth Investing: This strategy focuses on investing in stocks that are expected to grow at an above-average rate compared to their industry peers. Adobe is known for its innovative products and strong market position in the creative software industry, making it a prime candidate for growth investing.

- Value Investing: If you believe that Adobe's stock is undervalued based on its fundamentals, value investing might be your path. Look at the company's earnings, revenue growth, and P/E ratio to determine if it's trading below its intrinsic value.

- Dividend Investing: While Adobe is not primarily known for its dividends, some investors look for stocks that provide regular income. It’s important to keep an eye on the company's dividend policies and how they might evolve as Adobe continues to grow.

- Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of the stock price. This can reduce the impact of volatility and lower the average cost per share over time, making it a safer option for new investors.

- Sector Rotation: Consider the overall health of the tech sector when investing in Adobe. By shifting your investments based on economic cycles, you can take advantage of Adobe’s performance in times of sector growth.

Each of these strategies offers unique advantages and risks. It’s crucial to assess your financial goals, risk tolerance, and market conditions before selecting the right strategy for your portfolio. Don't forget to stay informed about Adobe's latest developments, as they can significantly influence your investment approach!

Also Read This: Understanding Adobe Stock and Its Functionality

6. Risks Involved in Investing in Adobe Stock

Investing in stocks, including Adobe, is not without its risks. Understanding these risks can help you make informed decisions and prepare for potential challenges. Here are some key risks to consider:

- Market Volatility: The stock market can be unpredictable. Adobe’s stock price may fluctuate based on market trends, investor sentiment, or broader economic conditions. Being prepared for these ups and downs is essential.

- Competition: Adobe operates in a highly competitive environment. Competitors like Canva and Corel can impact Adobe’s market share and profitability. Monitoring the competitive landscape is vital to understanding potential risks to your investment.

- Technological Changes: Rapid advancements in technology can render products obsolete. Adobe must continuously innovate to keep up with changes, and failure to do so might affect its growth and stock performance.

- Regulatory Risks: Changes in regulations regarding data privacy, software usage, and intellectual property can influence Adobe’s operations and profitability. Staying informed about relevant laws and policies can help mitigate this risk.

- Global Economic Factors: As a global company, Adobe is susceptible to economic fluctuations in different regions. Factors like currency exchange rates, international trade policies, and economic downturns can impact its financial health.

While these risks are significant, they shouldn’t deter you from investing in Adobe stock. Instead, consider them as part of your overall investment strategy. By diversifying your portfolio and staying informed, you can navigate these risks more effectively and work towards achieving your financial goals.

Also Read This: How to Access Your Behance Portfolio Offline

7. Long-Term vs. Short-Term Investment in Adobe

When it comes to investing in Adobe stock, one of the first decisions you'll face is whether to approach it as a long-term or short-term investment. Each strategy has its own set of advantages and challenges, so understanding the difference can help you make an informed decision.

Short-Term Investment

Short-term investing typically involves holding stocks for a few days to a few months. It often relies on market timing and technical analysis to capitalize on price fluctuations. If you’re considering short-term investments in Adobe, here are a few points to keep in mind:

- Market Volatility: Adobe's stock can respond quickly to market trends and earnings reports. By keeping an eye on short-term market movements, you may find opportunities to buy low and sell high.

- News Sensitivity: Major announcements, such as new product launches or significant partnerships, can lead to rapid price changes. Staying updated on Adobe's developments can give you an edge.

- Technical Analysis: Familiarize yourself with charts and indicators. Tools like moving averages can help identify potential entry and exit points for your trades.

However, short-term investing can be risky. Prices can be unpredictable, and it requires careful monitoring of both market conditions and Adobe's performance. It's ideal for those who enjoy the thrill of active trading and have the time to dedicate to it.

Long-Term Investment

On the other hand, long-term investing focuses on holding stocks for several years or even decades. This strategy allows you to benefit from Adobe's growth over time and ride out market fluctuations. Here are some benefits to consider:

- Compounding Growth: By holding onto your investment, you can benefit from compound growth. As Adobe continues to innovate and expand its product offerings, the stock price may increase significantly over time.

- Less Stress: Long-term investing typically requires less frequent monitoring of stock prices. Once you’ve done your research and made your investment, you can focus on other things while your investment grows.

- Tax Benefits: Holding onto stocks for over a year can lead to more favorable capital gains tax rates compared to short-term trading.

In summary, the choice between short-term and long-term investment in Adobe ultimately depends on your financial goals, risk tolerance, and how actively you want to manage your investments. If you prefer quick returns and can handle volatility, short-term might be for you. If you believe in Adobe's long-term potential and are willing to ride out the ups and downs, then long-term investing may be your best bet.

8. Resources for Tracking Adobe Stock Performance

Staying informed about Adobe’s stock performance is vital for making savvy investment decisions. Luckily, there are numerous resources at your fingertips to help you track their stock and understand market trends. Here are some of the best tools and platforms to consider:

- Financial News Websites: Websites like CNBC and Bloomberg provide up-to-the-minute news about Adobe and its market position. They often feature articles, interviews, and analysis that can offer valuable insights.

- Stock Market Apps: Apps like Robinhood or E*TRADE allow you to track stock performance in real-time, set alerts for price changes, and even execute trades right from your smartphone.

- Investment Research Platforms: Services like Morningstar or TheStreet provide in-depth analysis, ratings, and reports on Adobe's stock. These platforms can help you understand the company's fundamentals and future potential.

Social Media and Forums: Platforms like Reddit’s r/stocks or StockTwits allow investors to discuss their insights and share the latest news on Adobe and other stocks. Engaging in these communities can provide you with diverse perspectives on the stock’s performance.

SEC Filings: For the most reliable information, check out Adobe's filings with the Securities and Exchange Commission. These documents include earnings reports, annual filings (10-K), and quarterly filings (10-Q) that give you a deep dive into the company's financial health.

By utilizing these resources, you can effectively monitor Adobe’s stock performance and make more informed investment decisions. Whether you’re a seasoned investor or just starting, having access to the right tools can significantly enhance your investing experience.

admin

admin