Updating your knowledge about Adobe Systems stock shares can be quite insightful, especially if you’re looking to make informed investment decisions. Adobe is not just a leader in digital media and solutions; its stock performance over the years has captured the attention of investors worldwide. In this guide, we aim to walk you through the essentials of Adobe Systems stock, providing you with the right tools and insights to navigate the exciting world of investment.

Understanding Adobe Systems Stock

Before diving into the intricacies of updating your Adobe Systems stock shares, let’s take a moment to explore what Adobe stock represents and why it's a significant player in the financial arena.

Adobe Systems Incorporated, famously known for its creative software solutions like Photoshop and Acrobat, operates on a robust subscription-based model through its Adobe Creative Cloud. Here's a quick overview of its stock:

- Ticker Symbol: ADBE

- Market Capitalization: Approximately $150 billion (as of late 2023)

- Sector: Technology

- Industry: Software – Application

Investors are often drawn to Adobe stock for several key reasons:

- Strong Financial Performance: Adobe consistently demonstrates revenue growth and profitability.

- Innovative Product Offerings: The company continuously evolves its product suite to meet customer needs, enhancing its market position.

- Resilience: Adobe has shown remarkable resilience during economic fluctuations, making it a potentially safer bet for investors.

Furthermore, Adobe's stock is often analyzed using various metrics like price-to-earnings (P/E) ratios, dividend yields, and historical price trends. It’s crucial for any investor to stay updated on these metrics, which can help gauge the stock's performance in the market. Knowing where to access this information, whether through financial news outlets or stock analysis platforms, can provide a clearer picture of Adobe’s position in the ever-shifting tech landscape.

Also Read This: Resizing a Sublimation Image

3. Steps to Update Your Stock Shares

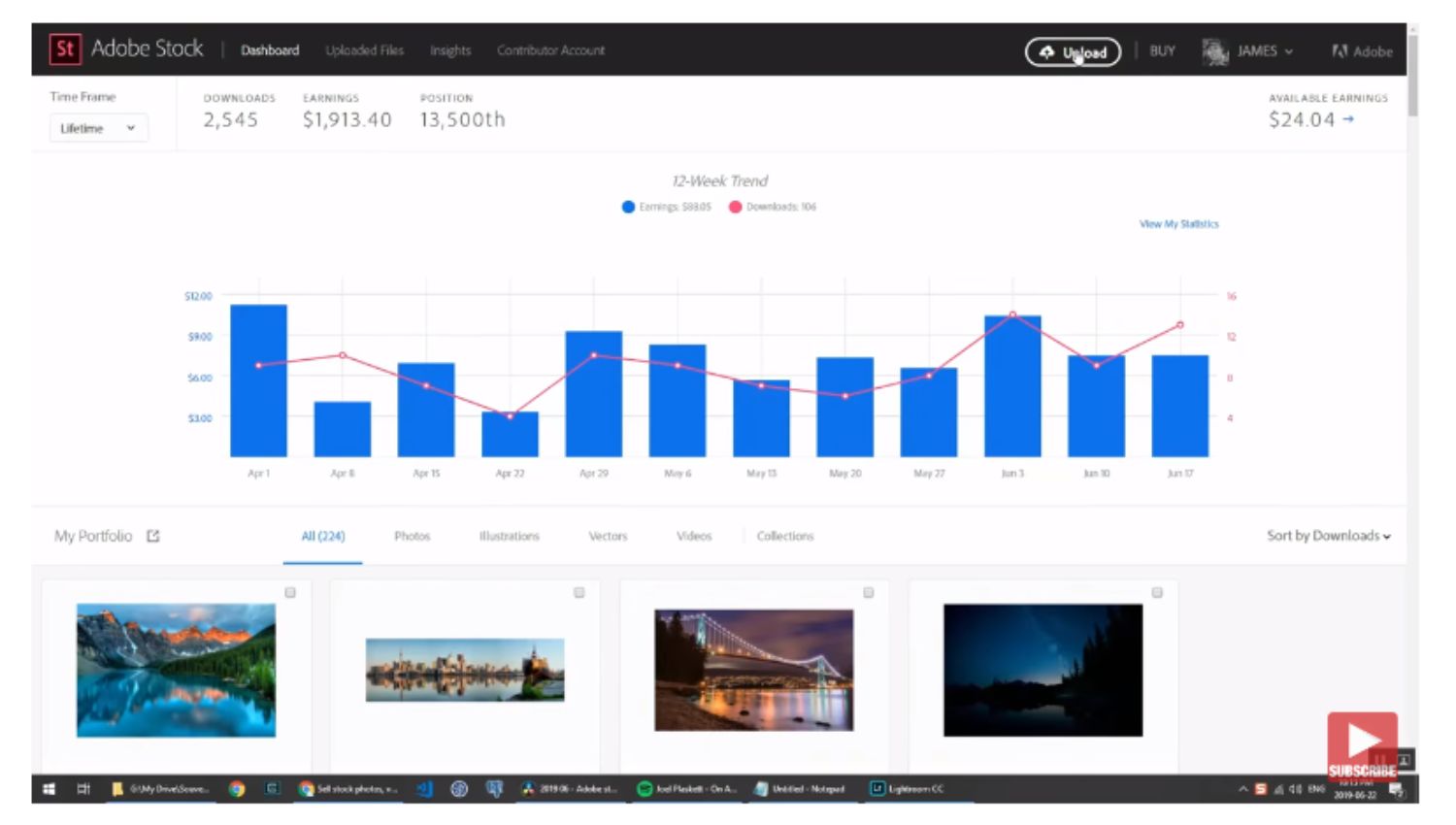

Updating your stock shares for Adobe Systems is an essential task for anyone looking to maintain an accurate portfolio. Here’s a simple step-by-step guide to help you navigate this process effortlessly.

- Log into Your Brokerage Account: Start by heading to your brokerage website and logging into your account. If you haven’t created an account yet, now’s the time!

- Access Your Portfolio: Once you’ve signed in, look for the “Portfolio” or “Accounts” tab. This section will display all your current holdings, including Adobe Systems shares.

- Search for Adobe Systems: Use the search bar to type in “Adobe” or its ticker symbol “ADBE.” Clicking on the result will provide you with detailed information about your shares.

- Review Share Information: Take a close look at your current holdings. Here you’ll find the number of shares you own, their current market value, and other vital statistics.

- Update Your Shares: If you bought or sold shares recently, ensure you input the changes. Look for options regarding buying, selling, or transferring shares. Follow the prompts as indicated.

- Confirm Updates: Double-check all entered information before submitting. It’s crucial to ensure that amounts and details are correct to avoid any potential losses.

- Monitor Your Portfolio: After you’ve updated your shares, take a moment to monitor the performance of your Adobe investment. Regular check-ins on your portfolio can help you make informed decisions.

Also Read This: How to Change Background in Adobe Photoshop CS5

4. Factors Influencing Stock Prices

Stock prices are like a rollercoaster ride, constantly moving up and down based on various factors. Understanding these can give you a clearer picture of what drives Adobe Systems' stock price. Let’s dive into some of the key influences:

- Earnings Reports: Adobe regularly releases earnings reports every quarter. Positive earnings can lead to a rise in stock prices, while disappointing results may cause prices to plunge.

- Market Trends: Broader market trends significantly impact stock prices. A bullish market usually encourages investors, driving up prices, whereas a bearish market often leads to declines.

- Company News: Announcements such as acquisitions, partnerships, and product launches can influence investor sentiment. Positive news often leads to price increases, while negative news can have the opposite effect.

- Economic Indicators: Factors like interest rates, inflation, and unemployment rates can affect stock prices. A strong economy typically boosts stock values, while economic downturns can depress them.

- Investor Sentiment: The mood of the investors can be a major driver. If investors feel optimistic about Adobe's future, demand for shares rises, increasing prices.

- Competition: Adobe operates in a highly competitive tech environment. Any significant movements by competitors can impact its stock price, either positively or negatively.

Keeping these factors in mind will help you make more informed decisions whether you’re updating your shares or considering new investments in Adobe Systems. Happy investing!

Also Read This: Effective Methods for Removing Getty Images Watermark on Mac

5. Tips for Managing Your Adobe Stock Investments

Investing in Adobe stock can be a rewarding experience, but it’s important to approach it with a solid strategy. Here are some practical tips to help you manage your Adobe stock investments effectively:

- Stay Informed: Keep up-to-date with Adobe’s latest news, quarterly earnings reports, and industry trends. Understanding the business landscape can help you make informed decisions about when to buy or sell shares.

- Diversify Your Portfolio: While Adobe is a strong company, it’s essential not to put all your eggs in one basket. Consider diversifying your investments across different sectors to mitigate risks.

- Set Clear Goals: Define what you want to achieve with your investments. Are you looking for short-term gains, or is this a long-term investment? Having clear goals can guide your decision-making process.

- Use Limit Orders: Instead of buying or selling shares at the market price, consider using limit orders. This allows you to specify the maximum price you're willing to pay or the minimum you’re willing to accept, potentially saving you money.

- Monitor Your Investments: Regularly review your investment performance. If Adobe’s stock isn't performing as expected, it might be time to reassess your strategy or look into other opportunities.

- Consult a Financial Advisor: If you're unsure about your investment choices, consulting a professional can provide personalized advice tailored to your financial situation and goals.

6. Conclusion

Updating your Adobe stock investments is not just about keeping an eye on numbers; it’s about fostering a proactive approach to your financial future. By staying informed and employing smart strategies, you can navigate the ups and downs of the stock market with confidence.

In summary:

| Key Takeaways |

|---|

| Stay updated on Adobe’s performance and industry trends. |

| Diversify to minimize risk. |

| Set realistic investment goals. |

| Utilize limit orders for better pricing. |

| Regularly monitor your stock’s performance. |

| Seek expert advice when needed. |

Investing in Adobe stock can open up numerous opportunities, so take your time to understand the landscape, and remember, a well-informed investor is often a successful one!

admin

admin