If you often shop on

Flipkart the

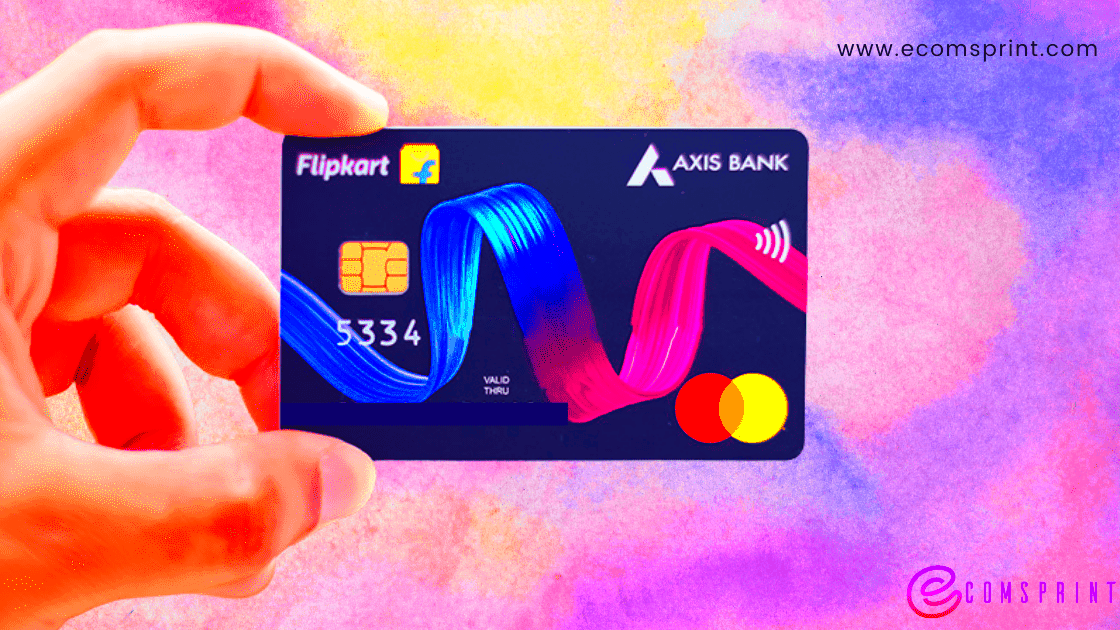

Flipkart Axis Bank Credit Card might be the perfect fit for you. This card is tailored to elevate your shopping journey on

Key Features and Benefits of the Credit Card

The

Flipkart Axis Bank Credit Card offers a variety of perks designed for those who love to shop online. Lets take a closer look at its key features.

- Welcome Benefits: Enjoy exclusive discounts and offers when you sign up for the card. It’s a great way to get started with immediate perks.

- Cashback Offers: Earn cashback on Flipkart purchases and a variety of other categories. This means you can save more with every transaction.

- Reward Points: Accumulate reward points on every purchase. These points can be redeemed for vouchers or discounts, adding more value to your spending.

- No Foreign Transaction Fee: For those who love to travel, this feature eliminates the extra charges on international purchases, making it a convenient option for global shopping.

- Priority Customer Service: Receive dedicated support from Axis Bank’s customer service team, ensuring that any issues or queries are handled promptly.

As someone who has personally utilized this card I can vouch for its ease of use and the benefits it brings. The cashback on

Flipkart purchases assists me in keeping my finances in check and the reward points are always a delightful addition, when making a purchase.

Eligibility Criteria for the Flipkart Axis Bank Credit Card

Before submitting your application for the

Flipkart Axis Bank Credit Card, make sure you check if you meet the eligibility requirements. Here are the key points to consider:

- Age: You must be at least 21 years old to apply for this credit card. For add-on cards, the minimum age requirement is 18 years.

- Income: A steady monthly income is essential. Generally, a minimum income of ₹25,000 per month is required, though this can vary based on your location and other factors.

- Credit Score: A good credit score, usually above 750, increases your chances of approval. It reflects your creditworthiness and helps in securing the best offers.

- Residency: You need to be a resident of USA. The card is available to both salaried and self-employed individuals.

When I submitted my application I realized how important it was to maintain a healthy credit score. Once I gathered the documents and fulfilled the eligibility criteria the process went smoothly. If you're thinking about applying make sure you meet these prerequisites for a seamless application journey.

Step-by-Step Guide to Applying for the Credit Card

Applying for the

Flipkart Axis Bank Credit Card may appear intimidating at first. However once you familiarize yourself with the procedure it becomes relatively easy. Here's a guide to assist you in navigating the application process.

- Check Your Eligibility: Before diving into the application, make sure you meet the eligibility criteria mentioned earlier. This ensures that you're on the right track from the beginning.

- Gather Required Documents: Collect all the necessary documents. These typically include proof of identity, address, and income. Having these ready will streamline the process.

- Visit the Flipkart Axis Bank Website: Go to the official website or the Flipkart app. You'll find a section for credit card applications. Click on the option to apply.

- Fill Out the Application Form: Enter your personal details, such as your name, address, and income. Double-check your information to avoid errors.

- Submit Your Documents: Upload the scanned copies of your documents as requested. Ensure they are clear and legible to avoid delays.

- Review and Submit: Carefully review your application before submitting. Make sure all information is accurate and complete.

- Wait for Confirmation: Once submitted, you’ll receive an acknowledgment email or SMS. This confirms that your application is being processed.

When I submitted my application I found it beneficial to gather all my paperwork in a single location and verify each detail. This straightforward organization made the procedure more efficient and quicker.

Documents Required for Application

Getting your paperwork in order is essential to ensure a seamless application journey. Heres a rundown of the documents you should have on hand.

- Proof of Identity: A government-issued ID such as Aadhaar card, passport, or driver’s license. This verifies your identity.

- Proof of Address: Recent utility bills, rental agreements, or bank statements that show your current address. This confirms where you live.

- Proof of Income: Salary slips for the last three months or income tax returns if you’re self-employed. This helps the bank assess your ability to repay.

- Photographs: Recent passport-sized photographs may be required for the application.

Based on what I’ve seen keeping your documents organized and current can really cut down on the back and forth. It’s definitely beneficial to take some time to make sure everything is in place before hitting that ‘submit’ button.

How to Track Your Application Status

After submitting your application for the Flipkart Axis Bank Credit Card you may be curious about the progress of your request. Here are some ways to stay updated on its status.

- Visit the Bank's Website: Go to the Axis Bank website and find the ‘Track Your Application’ section. Enter the reference number or application ID provided when you applied.

- Use the Mobile App: If you have the Axis Bank mobile app, you can also track your application status there. It’s convenient and quick.

- Contact Customer Service: If you prefer speaking to someone, you can call Axis Bank’s customer service. Provide your application details to get an update.

- Email Notifications: Keep an eye on your email. The bank often sends updates regarding your application status, so check your inbox regularly.

In my opinion, using the app to check the status is the most convenient option. Its quick and provides information on whether you need to take any additional steps.

Understanding the Fees and Charges

When looking at a credit card it’s important to be aware of the fees and costs involved. The Flipkart Axis Bank Credit Card is not different. Here’s an overview of the potential charges you may come across.

- Annual Fee: This is a fixed fee you’ll pay each year for holding the card. For the Flipkart Axis Bank Credit Card, the annual fee is typically around ₹500, but it can vary based on promotions or offers.

- Late Payment Fee: If you miss a payment, a late fee will be charged. This can range from ₹100 to ₹750, depending on the outstanding amount and your payment history.

- Foreign Transaction Fee: When you use your card abroad, a foreign transaction fee is applied. Thankfully, with the Flipkart Axis Bank Credit Card, there’s no such fee, making it a good choice for international travelers.

- Cash Advance Fee: If you use your card to withdraw cash, a cash advance fee applies. This is usually a percentage of the amount withdrawn, with a minimum charge applied.

- Interest Rates: Be aware of the interest rates on unpaid balances. These rates can be high, so it's wise to pay off your balance in full to avoid hefty interest charges.

From my perspective staying on top of these charges has been beneficial in preventing expenses. Being aware of what’s coming up helps me avoid any shocks when the invoice comes in. Taking the time to review the terms and conditions thoroughly is always wise, to stay well informed.

Comparing the Flipkart Axis Bank Credit Card with Other Options

With a plethora of choices out there selecting the perfect credit card can feel like a daunting task. To assist you in this process here’s a breakdown comparing the Flipkart Axis Bank Credit Card to its counterparts.

| Feature | Flipkart Axis Bank Credit Card | Standard Credit Card | Premium Credit Card |

|---|

| Annual Fee | ₹500 | ₹750 - ₹1,500 | ₹2,000+ |

| Cashback on Purchases | Up to 5% | 1% - 2% | 3% - 5% |

| Reward Points | Yes | Limited | Extensive |

| Foreign Transaction Fee | None | 1.5% - 3% | 1% - 2% |

I think the Flipkart Axis Bank Credit Card is a great option if you often make purchases online and want to enjoy Flipkart specific perks. While it may not be the fanciest choice available it provides decent value for use. If you’re seeking extensive travel rewards or luxury features a card could be more suitable for you.

FAQ

1. How long does it take to get approved for the Flipkart Axis Bank Credit Card?

Usually it takes around 7 to 10 working days for the approval process. But the timeline may change based on how many applications are received and how thorough your submission is.

2. Can I apply for this credit card if I have a low credit score?

Having a credit score can enhance your likelihood of getting approved, but you can still submit an application even with a lower score. The bank might take into account aspects such as your earnings and repayment track record.

3. Are there any annual fee waivers?

Indeed the yearly fee can be waived if you fulfill specific spending requirements. For detailed information refer to the terms and conditions or reach out to customer service.

4. What should I do if my card is lost or stolen?

As soon as you notice the loss, contact Axis Bank's customer service right away. They will help you block the card to stop any unauthorized transactions and assist you in getting a new one.

5. Can I use my Flipkart Axis Bank Credit Card internationally?

Absolutely, you can use it globally without facing any additional charges for foreign transactions, making it an excellent option for shopping abroad.

Conclusion

Applying for the Flipkart Axis Bank Credit Card can be a rewarding experience, especially if you're a regular shopper on Flipkart. With its attractive cashback offers, reward points and no foreign transaction fees it's designed to enhance your shopping experience and provide added benefits. Having used the card myself I can vouch for its convenience and the value it adds to my purchases.Just make sure to understand the fees involved and keep track of your spending to maximize its benefits. If you meet the eligibility criteria and frequently shop online this card could be a great addition, to your wallet.

The Flipkart Axis Bank Credit Card offers a variety of perks designed for those who love to shop online. Lets take a closer look at its key features.

The Flipkart Axis Bank Credit Card offers a variety of perks designed for those who love to shop online. Lets take a closer look at its key features. Before submitting your application for the Flipkart Axis Bank Credit Card, make sure you check if you meet the eligibility requirements. Here are the key points to consider:

Before submitting your application for the Flipkart Axis Bank Credit Card, make sure you check if you meet the eligibility requirements. Here are the key points to consider:

admin

admin