In today's fast-paced world, having an ATM card is like possessing a magic key to your finances. It gives you the freedom to access your money anytime, anywhere, making cash withdrawals or checking balances a breeze. But do you really know how to use it effectively? In this post, we’ll dive into the essentials of using your ATM card like a pro and ensure you get the most out of those machines instead of feeling lost or intimidated.

Understanding ATM Machines

ATM machines, or Automated Teller Machines, are self-service kiosks that allow you to perform a variety of banking transactions without the need for a bank teller. But before we delve into the specifics, let's take a moment to break down what an ATM machine can do for you:

- Withdraw Cash: The most common use of an ATM is to withdraw cash from your account.

- Check Account Balance: You can quickly check how much money you have in your account.

- Deposit Funds: Many ATMs allow you to deposit cash or checks directly into your account.

- Transfer Funds: You can transfer money between your accounts at the same bank.

- Pay Bills: Some ATMs offer the option to pay bills directly.

Now, let's explore the key components of an ATM machine:

| Component | Function |

|---|---|

| Card Reader | Reads your ATM card information to access your account. |

| PIN Pad | Allows you to enter your Personal Identification Number (PIN) securely. |

| Display Screen | Provides instructions and prompts during your transaction. |

| Cash Dispenser | Dispenses cash when you make a withdrawal. |

| Deposit Slot | Accepts deposits of cash or checks. |

| Receipt Printer | Prints a record of your transaction for your reference. |

When you approach an ATM, it’s essential to familiarize yourself with these components. Rushing in without understanding how everything works can lead to confusion or mistakes. Make sure you’re using a machine that belongs to your bank to avoid added fees, and always check the machine for any signs of tampering to protect your account from fraud.

Using an ATM is generally straightforward: Insert your card, enter your PIN, and select the transaction you wish to perform. However, understanding the nuances of the machine can enhance your experience. For example, you might want to check:

- Transaction Fees: Be aware of any fees associated with using an ATM that isn't part of your bank's network.

- Withdrawal Limits: Familiarize yourself with the daily withdrawal limits on your account.

- Availability of Services: Not all ATMs provide the same services — some only dispense cash, while others allow for deposits and account transfers.

In summary, understanding how ATM machines operate and being aware of their features can turn what might seem like a daunting task into a seamless experience. Being informed will empower you to utilize your ATM card to its fullest potential, making your banking experience quick and efficient. In the next section, we’ll explore tips to ensure your transactions are safe and secure!

Also Read This: How to Watch How Can She Slap Video on Dailymotion

3. Steps to Use an ATM Card

Using an ATM card is a straightforward process, but it’s essential to follow the right steps to ensure your transactions are smooth and secure. Whether you’re withdrawing cash, checking your balance, or performing other banking tasks, here’s a clear guide on how to effectively use your ATM card at any machine.

- Locate an ATM: First things first, find an ATM that is compatible with your bank’s network. This helps you avoid additional fees. Look for network logos (like PLUS or NYCE) on your ATM card that match those on the machine.

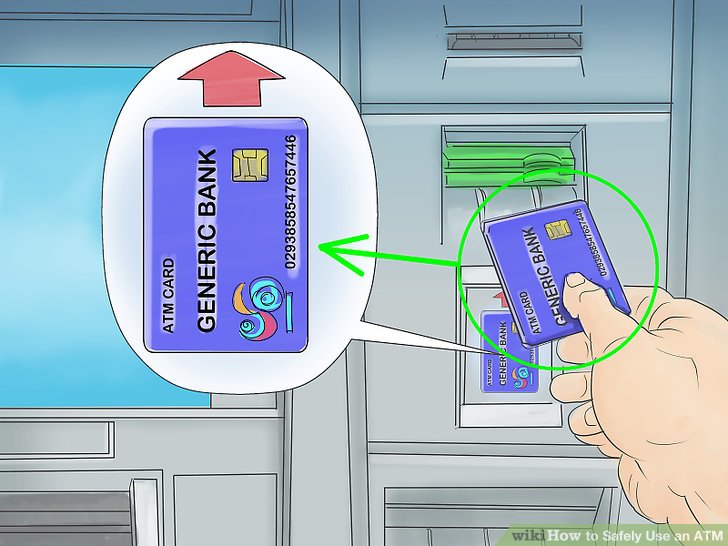

- Insert Your Card: To begin the transaction, insert your ATM card into the machine. Most ATMs will draw your card in, while others may require you to insert it face up. Make sure you see the prompts on the screen for guidance.

- Enter Your PIN: After the machine recognizes your card, you’ll be prompted to enter your Personal Identification Number (PIN). Make sure you enter it discreetly, as your PIN should always be kept confidential.

- Select Your Transaction: Once your PIN is validated, you’ll see a menu with various options. Choose the transaction you want to perform, whether it’s withdrawing cash, checking your balance, or something else.

- Follow the Prompts: After selecting your desired transaction, follow the instructions displayed on the screen. If you’re withdrawing cash, you’ll typically need to choose the amount you wish to take out.

- Collect Your Cash: If you’re withdrawing money, the machine will dispense your cash. Remember to take your cash promptly, as some ATMs will retract it after a short time.

- Retrieve Your Card: Don’t forget to retrieve your ATM card once your transaction is complete. Some machines automatically eject the card after the cash is collected, while others may wait until you prompt them.

- Ask for a Receipt: If you want a record of your transaction, request a receipt. This can be helpful for tracking your expenses and verifying transactions later.

And there you have it! With these simple steps, using your ATM card should feel like second nature. Just remember to keep your PIN safe and be aware of your surroundings when using an ATM.

Also Read This: How to Take a Screenshot on Your S4 Device Using Dailymotion Videos

4. Common Transactions You Can Perform

ATMs are incredibly versatile, allowing you to perform various banking transactions quickly and conveniently. Here are some of the most common transactions you can do with your ATM card:

- Cash Withdrawals: This is the most popular use of an ATM. You can withdraw cash from your checking or savings account. Just select the amount, and the machine will dispense your cash.

- Balance Inquiries: Want to see how much money you have? Use your ATM card to check your account balance anytime.

- Deposits: Many modern ATMs allow you to make deposits right at the machine. Just follow the prompts, insert cash or checks, and you’re good to go!

- Fund Transfers: If you need to move money between accounts, this is an easy task to do via ATM. You can transfer funds from one account to another with just a few clicks.

- PIN Changes: You can often change your ATM PIN directly at the ATM. This is crucial if you suspect your PIN has been compromised.

- Print Mini Statements: Some ATMs offer the option to print a mini statement of recent transactions, giving you a quick overview of your account activity.

By familiarizing yourself with these transactions, you’ll be able to leverage your ATM card to meet your banking needs effectively. Each of these functions is designed to make your banking experience more accessible and efficient.

Also Read This: How to Do Live Stream on Dailymotion

5. Security Tips for Using an ATM

Using an ATM card can be a convenient way to manage your money, but it also requires a bit of caution. Here are some essential security tips you should keep in mind when using an ATM:

- Choose the Right ATM: Opt for ATMs located in well-lit, busy areas, such as bank branches or shopping centers. Avoid isolated machines, especially at night.

- Look for Skimming Devices: Before inserting your card, inspect the ATM for any unusual attachments around the card slot or keypad. Skimmers can capture your card information without you noticing.

- Protect Your PIN: When entering your PIN, use your body to shield the keypad from any prying eyes or hidden cameras. It’s a good practice to cover your hand/keystrokes, ensuring your PIN remains confidential.

- Be Aware of Your Surroundings: Stay vigilant while using the ATM. If you notice anyone behaving suspiciously, it's best to cancel your transaction and leave.

- Keep Your Receipts: After completing a transaction, take your receipt and check your account regularly for any unauthorized transactions. This helps catch any fraud early.

Remember, being cautious can significantly reduce the risk of fraud or theft. Implementing these strategies will help you feel more secure during your ATM transactions!

Also Read This: How Much Is Rumble Worth and What Influences Its Valuation

6. Troubleshooting Common Issues with ATM Transactions

While ATMs are generally reliable, sometimes things don't go as planned. Here are some common issues you might encounter when using your ATM card, along with practical solutions to help you navigate these hiccups:

- Card Not Being Recognized: If the ATM doesn’t recognize your card, ensure it’s inserted correctly. Try gently cleaning the card with a soft cloth, as dirt or scratches can interfere with recognition.

- Transaction Declined: There could be several reasons for this. It might be that your account has insufficient funds or that there’s a hold on your card. Check your account balance via online banking or contact your bank for details.

- ATM Not Dispensing Cash: If you completed a transaction but did not receive cash, check your account balance to see if the amount has been deducted. If it has, wait a few minutes—sometimes, the machine may simply be slow. If the issue persists, report it to your bank immediately.

- Technical Errors on the Screen: If the ATM displays an error message, don’t panic! Most machines are programmed to reset after a few moments. If it doesn’t, you can safely cancel the transaction and try a different ATM.

- Stuck Card: If your card gets stuck, follow the on-screen instructions, which might instruct you to wait for it to be ejected. If it doesn’t come out after a few moments, call the bank’s help number posted on the ATM for assistance.

Keeping these solutions in mind can help you remain calm and collected when faced with typical ATM troubles. And remember, customer service representatives are just a call away should you need further assistance!

Also Read This: How to Turn Off Family Filters on Dailymotion Easily

7. Benefits of Using an ATM Card

Using an ATM card can greatly simplify how you manage your finances and access your money. Here are some of the standout benefits:

- Convenience: With an ATM card, cash is just a short drive away. You can access your funds anytime and anywhere there’s an ATM machine, without having to go into a bank.

- 24/7 Access: Unlike traditional bank hours, ATMs operate around the clock. Whether it's early in the morning or late at night, your money is readily available.

- Security: Carrying cash can be risky, but an ATM card allows you to keep your money in your account until you need it. Plus, if your card is lost or stolen, you can quickly report it to prevent unauthorized usage.

- Ease of Tracking: With many banking apps, you can see your transaction history quickly. Withdrawals made using your ATM card can be tracked, helping you keep an eye on your spending.

- Reduced Need for Checks: Many people find that using cash or debit simplifies their transaction methods. With an ATM card, you can withdraw cash as needed instead of writing checks, which can be cumbersome.

Additionally, many ATMs come with advanced features that allow you to:

- Change your PIN easily

- Deposit money directly into your account

- Check your account balance without needing to enter the bank

Overall, the benefits of using an ATM card shine in terms of accessibility, convenience, and security. Whether you're making daily purchases or need quick access to cash, your ATM card provides a reliable and user-friendly option.

8. Conclusion and Additional Resources

Incorporating an ATM card into your financial routine can streamline how you access and manage your funds, from withdrawals to deposits. Understanding how to effectively use your ATM card is essential for safeguarding your money and maximizing convenience. Here are a few key takeaways:

- Always check your surroundings before using an ATM.

- Keep your PIN confidential to ensure the security of your account.

- Regularly monitor your account transactions to detect any unauthorized activities.

For more information on managing your finances and using your ATM card effectively, consider checking out the following resources:

- National Bank of America - ATM Safety Tips

- Consumer Financial Protection Bureau - Using an ATM or Debit Card

- MyBankTracker - How Do ATM Cards Work?

In essence, with a little bit of knowledge and some common sense, using your ATM card can be a hassle-free way to manage your money. Next time you're at the ATM, you'll feel more confident knowing how to use it safely and wisely!

admin

admin