Did BlackRock really acquire Rumble? This question has been buzzing around investment circles and social media alike. In a world where financial giants are constantly on the lookout for the next best thing, understanding the dynamics of such acquisitions is crucial. In this post, we’ll dive into who BlackRock is and the strategies it employs when making investment decisions. Let’s get started!

Overview of BlackRock and Its Investment Strategy

Founded in 1988, BlackRock has grown to become one of the world’s largest asset management firms, with over $9 trillion in assets under management. The firm’s primary mission is to help clients—individuals, institutions, and governments—navigate their investment challenges. But what truly sets BlackRock apart is its investment strategy. Understanding this can bring clarity to any discussions about potential acquisitions.

BlackRock operates on a principle of building diversified portfolios that align with its clients’ goals and risk tolerance. Here are some key aspects of their investment strategy:

- Diversification: They believe in spreading investments across various asset classes to mitigate risk and enhance returns.

- Data-Driven Decisions: BlackRock leverages advanced analytics and data technology to inform their investment choices, ensuring they are based on solid evidence rather than gut feelings.

- ESG Focus: Environmental, Social, and Governance (ESG) factors are integrated into their investment processes, reflecting a growing commitment to sustainability and ethical considerations in finance.

- Long-Term Perspective: Rather than chasing short-term gains, BlackRock emphasizes a long-term investment horizon, which is crucial for wealth preservation and growth.

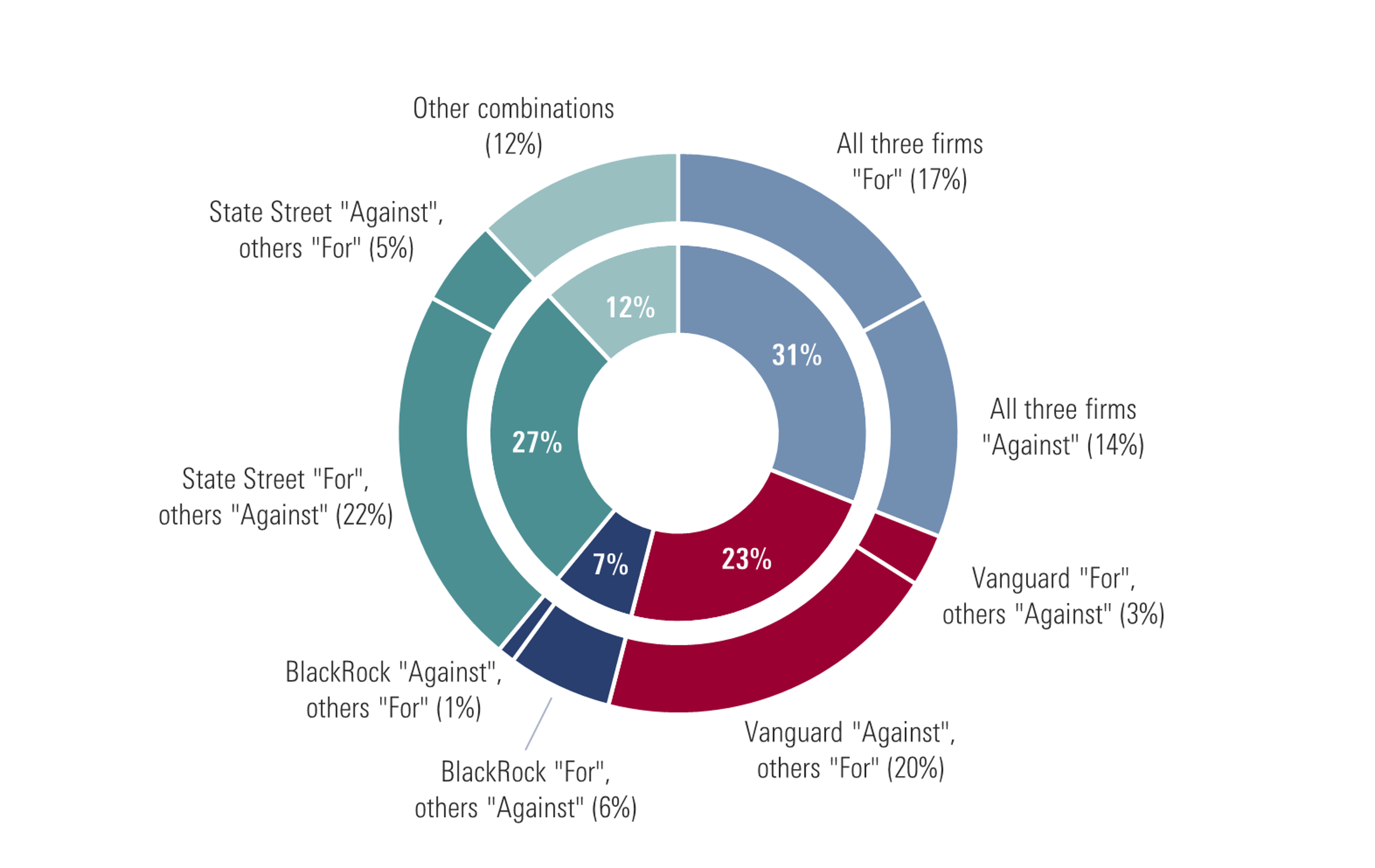

One of BlackRock’s most notable advantages is its scale. With vast resources at its disposal, the firm can pursue a diversified range of investment opportunities across various sectors. This flexibility often leads to significant influence in the companies it invests in—even if it does not outright acquire them.

Now, when it comes to potential acquisitions, BlackRock approaches these opportunities carefully. The firm looks for companies that align with its investment strategies and can benefit from its operational expertise. Acquisitions can serve multiple purposes, such as:

- Enhancing Diversification: Acquiring a company in a different sector can help diversify their portfolio even further.

- Accessing New Technologies: Investments in tech companies or platforms like Rumble may provide insights and innovative solutions that can benefit their other clients.

- Strengthening Market Position: Strategic acquisitions can bolster BlackRock's standing within the financial industry.

In summary, understanding BlackRock’s investment strategy provides valuable context for discussions surrounding their potential involvement with Rumble or similar platforms. The firm's experience, data-driven approach, and emphasis on long-term growth render them a significant player in the investment world. In the next sections, we’ll delve deeper into the implications of these strategies and whether they’re likely to acquire platforms like Rumble in the near future.

Also Read This: Did the Rumbling Destroy Paradis? A Closer Look at the Consequences of the Event

3. What is Rumble? A Brief Introduction to the Platform

If you’ve been scrolling through social media or catching up on the latest tech news, you’ve probably heard of Rumble. But what exactly is it? Rumble is a video-sharing platform that positions itself as an alternative to mainstream services like YouTube. Launched in 2013,

What sets Rumble apart? Here are a few key points:

- Content Freedom: Rumble promotes itself as a platform where all voices can be heard, regardless of their political or social views. This has attracted a variety of creators who may feel censored on other platforms.

- Monetization Opportunities: Content creators can monetize their videos in several ways. This includes direct ad revenue sharing, licensing deals, and even partnerships with brands. Rumble's monetization model has drawn in many content creators looking for better financial incentives.

- Simplicity and User-Friendly Interface: The platform is designed to be easy to use, making it accessible to both content creators and viewers. Users can navigate through categories, trending topics, and more without a steep learning curve.

Rumble has gained a following not just for its unique approach to video sharing, but also for its ability to draw significant viewership, especially from audiences who might feel disenfranchised by the algorithms of bigger platforms. This rise in popularity has led to a diverse range of content, from political commentary to lifestyle vlogs and everything in between.

With its focus on attracting a different demographic, Rumble has been increasingly seen as a challenger to larger platforms amidst growing discussions around censorship and content ownership in the digital age. As it continues to evolve, many are curious about how its business strategies and partnerships—and now its relationship with major investment firms like BlackRock—will shape its future.

Also Read This: How to Watch Rumble on Roku: A Step-by-Step Guide

4. Recent Developments in BlackRock and Rumble's Relationship

Now, let’s dive into the intriguing relationship between BlackRock and Rumble. BlackRock, known primarily as one of the largest asset management firms globally, has been in the news for various reasons recently, including significant investments in technology and media sectors. Reports have emerged suggesting that BlackRock has taken a stake in Rumble, igniting a mix of curiosity and skepticism in the investment community.

Why is this partnership noteworthy? Here are some recent developments:

- Strategic Investment: BlackRock's investment in Rumble is seen as part of its broader strategy to diversify its portfolio, especially in industries that promote digital content consumption and expression.

- Market Reactions: Following the news of BlackRock's involvement, Rumble's stock—if publicly traded—might see fluctuations based on investor confidence and speculative sentiment regarding content platforms with less conventional business models.

- Future Directions: Many industry analysts are speculating on what this could mean for Rumble's operational strategies. With BlackRock's influence, Rumble may have access to more resources, enabling it to refine its technology, expand its user base, and improve the overall platform experience.

As Rumble continues to grow, the relationship with BlackRock could potentially play a significant role in shaping the future of the platform. Could we see Rumble becoming a more prominent player in the online content space? Only time will tell, but the intersection of finance and tech is undeniably an exciting realm to watch.

As developments unfold, it’s essential for both viewers and content creators on Rumble to stay informed about how these shifts may impact the platform—and more broadly, the nature of free speech and content ownership in the digital landscape.

Also Read This: When Is Royal Rumble 2024 Happening Full Event Schedule

5. Analysis of BlackRock's Investment Impact on Rumble

BlackRock, the world's largest asset management firm, making a strategic investment in Rumble has raised eyebrows across the financial and tech landscapes. You might be wondering, "What does this really mean for Rumble?" Let's dive into the potential impacts of this investment.

First and foremost, having a heavyweight like BlackRock onboard can significantly enhance Rumble's reputation. When a major player in the investment world backs a platform, it signals confidence, which can attract more users and content creators. Rumble is primarily known for its commitment to free speech and an alternative approach to mainstream media, and BlackRock's involvement could strengthen its position in the crowded video-sharing space.

Furthermore, this investment may lead to increased financial resources for Rumble. With access to more capital, Rumble could ramp up its marketing efforts, enhance platform features, and invest in technologies that improve user experience. Imagine faster uploads, better streaming quality, and more robust community features—these are all possibilities that could emerge from a financial boost.

On the flip side, there are concerns about what this investment means for Rumble's autonomy. Some users might worry that BlackRock's interest—primarily focused on generating returns—could lead to changes in Rumble's policies or content moderation practices. u201cWill they impose restrictions or push a particular agenda?u201d is a question on many minds. Maintaining the platform’s original values will be crucial as they navigate this financial partnership.

In summary, BlackRock's investment could propel Rumble to new heights in terms of growth and functionality but comes with a set of challenges that the platform will need to address carefully. Monitoring user engagement and maintaining transparency will be key factors in how Rumble manages these changes moving forward.

Also Read This: How to Add a Friend in My Hero Ultra Rumble and Join the Fun

6. Reactions from Rumble's Community and Users

The announcement of BlackRock's investment in Rumble has sparked a whirlwind of reactions among the platform's users and the broader community. It’s fascinating to see how different stakeholders perceive the implications of this financial development.

Many users who appreciate Rumble's mission of promoting free speech have expressed mixed feelings. On one hand, some are excited about the potential for improved features and increased visibility for creators. Comments like, u201cThis could be a game-changer for us!u201d highlight a sense of optimism about what more investment could bring to the platform.

On the other hand, there’s a palpable sense of skepticism and concern. A number of users are worried about corporate influence. The sentiment is captured by comments like u201cI just hope BlackRock doesn’t try to change what Rumble stands for.u201d This apprehension is especially evident among those who value Rumble as a sanctuary for diverse opinions, away from what they perceive as censorship on other platforms.

Community forums have become hotbeds of debate. Some users advocate for vigilance, suggesting that Rumble should uphold its core values and ensure that new policies are in line with user expectations. They're also encouraging fellow users to stay engaged and actively participate in discussions about the platform's future—after all, the community's voice matters.

- Supporters of the investment:

- Excited about better platform capabilities.

- Hopeful for increased funding for creators.

- Skeptics of the investment:

- Concerned about potential censorship.

- Anxiety over corporate interests overshadowing platform values.

Overall, the reactions from Rumble's community indicate a deep emotional investment in the platform's future. Users are keenly aware that while BlackRock's investment could be beneficial, it also demands careful navigation to maintain the essence of what makes Rumble unique. As this narrative evolves, it will be interesting to see how Rumble balances growth with the values its community holds dear.

Also Read This: How Are Royal Rumbles Planned? Behind the Scenes of WWE’s Most Iconic Match

7. Future Implications of the Investment for Rumble

The potential acquisition of Rumble by BlackRock raises a fascinating array of possibilities for both companies. First, let's consider what it could mean for Rumble, the growing platform known for its commitment to free speech and alternatives to mainstream media. With BlackRock’s capital backing, Rumble could significantly enhance its infrastructure and expand its reach. This investment might lead to:

- Enhanced Technology: With additional funding, Rumble can invest in better technology, improving user experience and content delivery.

- Increased Marketing: BlackRock's resources could fuel aggressive marketing campaigns, attracting more users and content creators to the platform.

- Strategic Partnerships: BlackRock’s extensive network might facilitate partnerships with other media outlets, tech companies, and influencers, elevating Rumble's profile.

- Content Diversity: An increased budget could enable Rumble to attract a more diverse array of content creators, making the platform a more dynamic place for users.

On the other hand, such significant investment can come with challenges. Rumble must navigate maintaining its core values while possibly appeasing larger corporate interests. The delicate balance between operational freedom and corporate influence might evolve, raising questions about how user trust can be preserved. In the face of potential censorship concerns, Rumble might have to double down on its commitment to freedom of expression to retain its user base.

Moreover, as competition in the digital landscape intensifies, the implications of this investment could steer Rumble towards collaboration or confrontations with larger tech entities. Will Rumble become a viable contender against giants like YouTube and Vimeo? Or will it find itself in a defensive posture, protecting its niche audience against overarching corporate influence? Only time will tell how this partnership plays out and what it means not just for Rumble but for the broader landscape of online media.

8. Conclusion: The Significance of BlackRock's Involvement in Rumble

In summary, BlackRock's involvement in Rumble is not just a financial investment; it symbolizes a significant moment in the ongoing evolution of digital media. As a powerhouse in global finance, BlackRock's interest could amplify Rumble's ambitions but also complicate its essence. It raises critical questions about the nature of modern media, user engagement, and the balance of power in the digital space.

Understanding this investment also prompts reflection on the broader implications for competition in the media landscape. If Rumble leverages BlackRock's resources effectively, it could redefine the dynamics with major players. The question that lingers is: will Rumble remain the platform focused on free speech it pledged to be, or will it morph into a more conventional corporate entity, driven by profit?

As users and analysts, we must pay attention to how this investment unfolds. It serves as a case study not just for individual platforms but for the evolving intersection of finance, media, and freedom of expression. Hence, while the immediate effects may take time to materialize, the long-term narrative could reshape how we view content creation and consumption.

Ultimately, the stakes are high, and the road ahead for Rumble with BlackRock will be closely followed by investors, users, and media analysts alike. By keeping an eye on these developments, we can better understand the ongoing shifts in digital media and what they mean for the future of free expression online.

admin

admin