Rumble, a video-sharing platform promoting free speech, has gained significant traction in recent years. As it transitions to a publicly traded company, many investors are curious about its stock value. In this blog post, we’ll dive into what Rumble stock represents, its current market price, and how it fits into the broader landscape of digital media stocks. Let’s explore the nuances!

Understanding Market Value of Rumble Stock

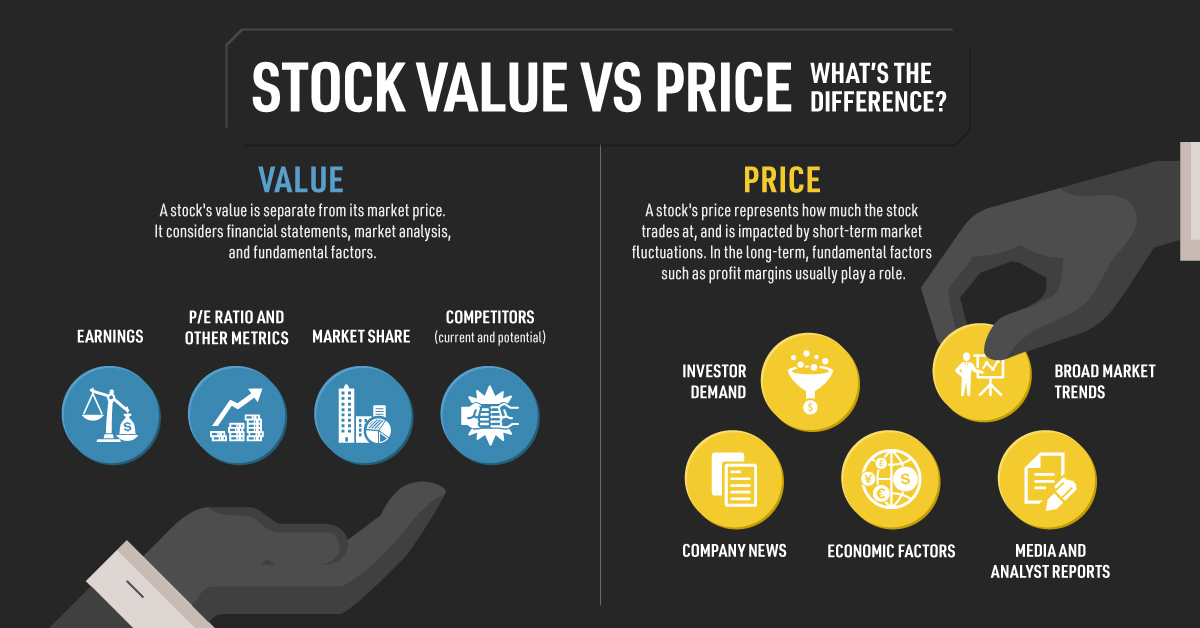

The market value of Rumble stock is a crucial indicator for investors. But what does it mean? Essentially, market value refers to the total worth of the company, calculated by multiplying the current stock price by the number of outstanding shares. For instance, if Rumble's stock is priced at $10 and there are 100 million shares available, the market value would be $1 billion.

To grasp Rumble's market dynamics, we must consider various factors:

- Market Sentiment: Investor sentiments can fluctuate based on news, trends, and broader market conditions. For example, if a major influencer endorses Rumble, you might see a spike in stock value.

- Financial Performance: Earnings reports, revenue growth, and user engagement metrics play a critical role. A positive earnings report could lead to an increase in stock prices, while disappointing figures might have the opposite effect.

- Competition: The digital media space is saturated with platforms like YouTube, TikTok, and Twitch. Rumble’s ability to differentiate itself can impact its stock value significantly.

Investors often analyze various metrics to gauge a stock's value:

| Metric | What It Indicates |

|---|---|

| P/E Ratio (Price-to-Earnings) | Measures a company's current share price relative to its earnings per share. A high P/E might indicate overvaluation. |

| PEG Ratio (Price/Earnings to Growth) | Accounts for growth; a lower PEG ratio could suggest undervaluation compared to its growth prospects. |

| Market Capitalization | A reflection of the company's size; a larger cap usually indicates stability, while smaller caps can be more volatile. |

Ultimately, understanding Rumble's market value requires a blend of these metrics and external factors. Investors should remain vigilant, as sentiment can change rapidly in today's fast-paced market. Be sure to keep an eye on Rumble's developments—both on the platform and in the stock market, as these will shape its future value!

Also Read This: Does the Pro Controller Have HD Rumble on the Nintendo Switch? Everything You Should Know

3. Factors Influencing Rumble Stock Price

When it comes to understanding the fluctuations in Rumble's stock price, several key factors come into play. Let's break them down into manageable bits.

1. User Growth and Engagement: One of the biggest drivers of Rumble's stock value is its user base growth. The more users the platform attracts, the better its revenue potential. For instance, if Rumble reports a significant uptick in daily active users or engagement metrics, investors are likely to respond positively, pushing the stock price higher.

2. Content Creator Partnerships: Collaborations with popular content creators can have a tremendous impact. When high-profile creators join Rumble or announce exclusive content deals, it not only boosts the platform’s visibility but also attracts more users. This, in turn, can lead to a rise in stock value.

3. Competition: The online video platform space is crowded. Companies like YouTube and TikTok are significant competitors. If Rumble can differentiate itself effectively or capture a niche audience, it could see its stock price climb. On the flip side, if competitors introduce new features that lure users away, Rumble's stock may take a hit.

4. Financial Performance: Quarterly earnings reports provide investors with crucial information about Rumble's financial health. Metrics like revenue growth, profit margins, and user acquisition costs can sway stock prices significantly. For example, a report showing higher-than-expected revenue could lead to a surge in stock price.

5. Regulatory Environment: Given the scrutiny that tech companies face regarding content moderation and user data, any regulatory changes can impact Rumble's operations and, subsequently, its stock price. Keeping an eye on policy shifts can help investors anticipate potential price movements.

In summary, a mix of user engagement, partnerships, competitive landscape, financial results, and regulatory factors intertwine to influence Rumble's stock price. Investors who stay informed about these dynamics are better positioned to make savvy decisions.

Also Read This: How to Get an Aura in My Hero Ultra Rumble and Enhance Your Gameplay

4. Recent Performance and Trends in Rumble Stock

As we dive into Rumble's recent stock performance, it's important to recognize that the market is always in flux. Rumble's stock has been on quite the rollercoaster ride lately, reflecting shifts in both investor sentiment and market conditions.

Stock Price Trends: Over the past few months, Rumble's stock has seen both highs and lows. For example, after a strong earnings report in July, where user growth exceeded expectations, the stock jumped by approximately 15%. However, this was followed by a slight downturn due to broader market corrections, demonstrating how volatility can be a constant companion in the stock market.

Market Sentiment: Investors' sentiment plays a crucial role in Rumble's stock trends. Recently, there has been growing enthusiasm for alternative platforms, especially those that promise less censorship and more freedom for content creators. As Rumble has positioned itself as a champion of free speech, this trend has increasingly attracted investors looking for opportunities outside mainstream platforms.

Trading Volume: Trading volume is another indicator of market interest. Recently, Rumble's stock has experienced spikes in trading volume, particularly after announcements about new features or partnerships. Increased trading volume often indicates heightened investor interest and can foreshadow significant price movements.

Analyst Ratings: Analysts have mixed opinions on Rumble's outlook. Some see tremendous growth potential due to its unique value proposition, while others express caution, citing competition and market saturation. Keeping an eye on analyst ratings can provide insights into the stock’s potential trajectory.

In short, Rumble's recent performance showcases a blend of promising trends and inherent risks. Market dynamics, user engagement, and evolving sentiments continue to shape its stock's journey. For smart investors, staying aware of these trends is crucial to navigating the exciting yet unpredictable world of Rumble stock.

Also Read This: How Much Does Rumble Cost? A Guide to Platform Pricing and Features

5. Comparative Analysis with Similar Stocks

When evaluating Rumble's stock value, it's essential to look at how it stacks up against similar companies in the digital media and streaming sector. By comparing key metrics such as market capitalization, price-to-earnings (P/E) ratio, and growth potential, investors can gain a clearer picture of Rumble's position.

Similar Stocks to Consider:

- Roku Inc. (ROKU): A well-known name in streaming, Roku offers a comprehensive platform for content distribution. Currently, it has a P/E ratio significantly higher than Rumble’s, reflecting a market that values its growth potential.

- Pinterest Inc. (PINS): While not a direct competitor, Pinterest shares a similar audience demographic interested in visual content. Its market strategies can provide insights into Rumble's potential growth paths.

- Vimeo (VMEO): Focused on video hosting and sharing, Vimeo competes increasingly with Rumble. Their subscription model versus Rumble's ad-driven approach creates a dynamic comparison.

In terms of market capitalization, Rumble's value sits significantly lower than that of Roku and Vimeo, which raises questions about its scalability. However, it's crucial to note that Rumble operates under a different model, prioritizing free speech and user-generated content. This unique approach might appeal to a growing segment of users disillusioned with mainstream platforms.

Investors should also consider the growth rates of these companies. For instance, Roku has reported robust user growth, while Rumble is still in its early phases of scaling its user base. This presents an opportunity for Rumble to carve out its niche, especially among users prioritizing alternative platforms.

Ultimately, while Rumble's stock isn't as strong as some of its competitors at the moment, its unique positioning could lead to significant upside potential as it continues to grow and attract a committed user base.

6. Future Outlook for Rumble Stock

The future outlook for Rumble stock is a topic of much speculation, as it hinges on several factors including user growth, monetization strategies, and the ever-evolving media landscape. As the platform positions itself as a haven for free speech and alternative content, it may find a receptive audience willing to support its mission.

Key Factors Influencing Future Growth:

- User Acquisition: Rumble's ability to attract and retain users will be crucial. If the platform can capitalize on current trends in user dissatisfaction with larger platforms, it could see significant growth.

- Monetization Strategies: The effectiveness of its ad-based revenue model will be tested as it scales. Rumble's commitment to not censoring content can attract niche advertisers looking to connect with a specific audience.

- Partnerships and Collaborations: Strategic partnerships could enhance its content offerings and user engagement. Collaborations with content creators or influencers can significantly boost visibility and credibility.

Market analysts suggest that if Rumble can sustain its growth trajectory while maintaining its unique value proposition, it could position itself favorably against larger competitors. This is especially relevant as more users seek alternatives to traditional social media, especially in light of increasing concerns over content moderation and censorship.

In summary, while Rumble's stock may currently reflect a cautious market sentiment, its potential for future growth could be substantial. Investors should keep an eye on user acquisition metrics and revenue developments in the coming quarters. With the right strategies, Rumble could not only maintain its stock value but possibly create new opportunities for significant appreciation.

admin

admin