Turning your attention to Rumble as a potential investment opportunity can be quite intriguing. As a platform that has steadily been gaining traction in the social media landscape, Rumble presents a unique proposition for investors looking to diversify their portfolios. With a focus on user-generated content and a robust system for monetization, it’s positioned as a strong contender against more established giants like YouTube, especially among users seeking alternatives for content sharing.

Whether you’re an experienced investor or just starting out, understanding the nuances of Rumble’s offerings is crucial. This guide aims to provide you with insights into what makes Rumble an appealing investment choice and shares tips to navigate the stock purchase process effectively.

Understanding Rumble's Business Model

To grasp Rumble's potential in the investment arena, let’s dive deep into its business model. Rumble operates primarily as a video-sharing platform, where content creators can upload, share, and monetize their videos. Here are the main components that define

- User-generated Content: Much like YouTube, Rumble allows users to generate and share their content, which forms the backbone of the platform. This not only keeps users engaged but also continuously attracts new ones.

- Monetization Opportunities: Rumble offers multiple revenue streams for content creators. They can earn through ad revenue, licensing agreements, and sponsorships, encouraging more users to join and create quality content.

- Partnerships: The platform has formed strategic partnerships with other media outlets to boost content discoverability, enhancing their reach and user base.

Additionally, Rumble takes a different approach by promoting a free-speech policy, appealing to creators and audiences who feel stifled by more mainstream platforms. This commitment could carve out a niche market that presents a strong case for investment.

| Key Element | Significance |

|---|---|

| User Engagement | Crucial for content growth and retention |

| Diverse Revenue Streams | Reduces dependency on a single income source |

| Niche Market Appeal | Targets underserved demographics |

Understanding these components allows investors to see the foundational strengths that Rumble has and may provide insights into its future expansion and profitability in the fast-growing digital content landscape.

Steps to Purchase Rumble Stock

Purchasing Rumble stock can be an exciting venture, especially if you are looking to invest in a promising platform that encourages user-generated content. Here’s a straightforward guide to get you started:

- Research and Analysis:

Before diving in, it's essential to do your homework. Understand Rumble's business model, financial health, and market position. Look out for key indicators such as:

- Revenue growth

- Profit margins

- User engagement metrics

- Choose a Brokerage:

Select a brokerage platform that suits your investing style. Options range from traditional brokers to digital platforms like Robinhood or E*TRADE. Make sure it offers Rumble stock.

- Create an Account:

Follow the platform’s procedure to set up your account, verifying your identity and linking your bank details. This process usually includes inputting personal information and possibly providing financial history.

- Fund Your Account:

Add funds to your trading account. You can transfer money from your bank account, typically involving a few business days for processing.

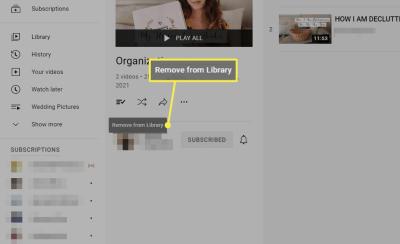

- Buy Rumble Stock:

Once your account is funded, search for Rumble stock using its ticker symbol. Decide on the number of shares you want to purchase and place an order, whether it’s a market order (buying at current prices) or a limit order (setting a price you’re willing to pay).

And just like that, you're an owner of Rumble stock! Keep an eye on your investment and stay informed about any market changes.

Tips for Successful Investing in Rumble

Investing successfully in Rumble, or any stock, involves careful strategy and a bit of finesse. Here are some tips to guide you on your journey:

- Diversify Your Portfolio:

Don't put all your eggs in one basket! While Rumble may seem like a promising investment, diversify across different sectors to minimize risk.

- Stay Informed:

Regularly follow news and updates related to Rumble. Understanding market trends and company announcements can make a substantial difference in your investment decisions.

- Set Realistic Goals:

Establish clear, realistic investment goals to avoid disappointment. Rather than aiming for overnight success, consider setting up short-term and long-term objectives.

- Monitor Your Investments:

Keep track of your investment's performance. Use tools and apps that provide analytics to help you gauge whether adjustments are necessary.

- Avoid Emotional Trading:

It’s easy to get carried away with market highs and lows. Stick to your strategy and avoid making impulsive decisions based on emotions.

By following these tips and practicing due diligence, you’ll be better positioned for success in your Rumble investment journey!

5. Analyzing Rumble's Market Position

When peering into Rumble's market position, it’s essential to take a close look at a few key factors that shape its standing in the competitive landscape. Rumble has emerged as an alternative video platform, gaining traction especially among those who feel sidelined by mainstream social media. Its audience primarily consists of content creators and viewers who value free speech and are looking for an outlet without the constraints often found elsewhere.

Here’s a quick breakdown of Rumble's market position:

- Target Audience: Primarily users seeking a more diverse content landscape, including conservative and independent creators.

- Content Creation: Many users opt for Rumble to escape censorship, creating a niche that attracts a dedicated user base.

- Partnerships: Rumble has forged several partnerships with creators and organizations that align with its ethos, enhancing its visibility.

- Monetization Opportunities: The platform allows content creators to monetize their videos, providing further incentive for participation.

In terms of market share, Rumble is a small player compared to giants like YouTube, but its growth rate and the influx of new users are noteworthy. According to recent statistics, Rumble has experienced:

| Metric | Stat |

|---|---|

| Monthly Active Users | Over 40 million |

| Content Creators | Thousands signing up monthly |

Overall, analyzing Rumble’s market position reveals a platform that's carving out its own space amid the competition, despite the challenges it faces.

6. Risks Associated with Investing in Rumble

Investing in Rumble—or any rapidly evolving tech platform—comes with its own set of risks that potential investors should consider. It’s essential to do your homework before putting any money on the table. Here are some prominent risks to keep in mind:

- Market Volatility: Tech stocks, especially in the realm of social media, can be incredibly volatile. Rumble is still establishing itself, making its stock susceptible to dramatic changes.

- Regulatory Challenges: As a platform that champions free speech, Rumble navigates complex regulatory waters, especially regarding content moderation and data privacy laws.

- Competition: The video-sharing space is fiercely competitive. Rumble faces challenges from both established players and emerging platforms, which can impact its growth.

- Monetization Sustainability: While Rumble currently offers creators monetization options, the sustainability of this model is uncertain and could affect its revenue streams.

- Reputation Risks: The platform’s stance on content can attract scrutiny or backlash, impacting user trust and, subsequently, its user base.

Each of these risks should be carefully weighed against potential rewards. By understanding these factors, investors can make more informed decisions regarding their engagement with Rumble's stock offerings.

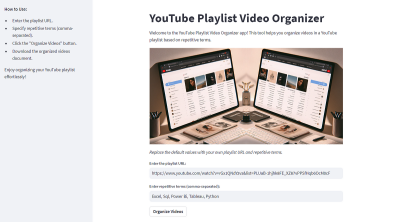

Investing in Rumble Guide for Stock Purchase and Tips

Investing in the stock market can often seem daunting, especially for beginners. However, with the right knowledge and tools, anyone can become a confident investor. The Rumble Guide is an essential resource for anyone looking to enhance their stock purchasing strategies and investment technique.

This guide provides valuable insights and tips designed to empower investors. Here are some key features:

- Understanding Stocks: A comprehensive overview of what stocks are, types of stocks (common vs. preferred), and how they work in the marketplace.

- Research Techniques: Practical advice on how to conduct due diligence, including key financial metrics to analyze before purchasing stock.

- Investment Strategies: Exploration of various investment strategies—such as value investing, growth investing, and dividend investing—that cater to different financial goals.

- Market Trends: Tips on how to stay updated with market trends and economic indicators that may affect stock performance.

- Risk Management: Essential guidance on how to manage risk and diversify your portfolio effectively.

Table 1 below summarizes the various strategies included in the Rumble Guide:

| Investment Strategy | Description |

|---|---|

| Value Investing | Buying undervalued stocks based on fundamental analysis. |

| Growth Investing | Investing in companies with potential for high growth. |

| Dividend Investing | Focusing on stocks that pay regular dividends for income. |

Utilizing the Rumble Guide can provide novice and seasoned investors alike with invaluable tools to make informed decisions when purchasing stocks. With the right preparation and understanding acquired from this guide, investors can navigate the stock market with confidence.

Conclusion and Final Thoughts

In conclusion, investing in the Rumble Guide offers a wealth of knowledge and practical tips that can help individuals at all levels improve their stock purchasing skills. With the right strategies and insights, successful investing is within reach.

admin

admin